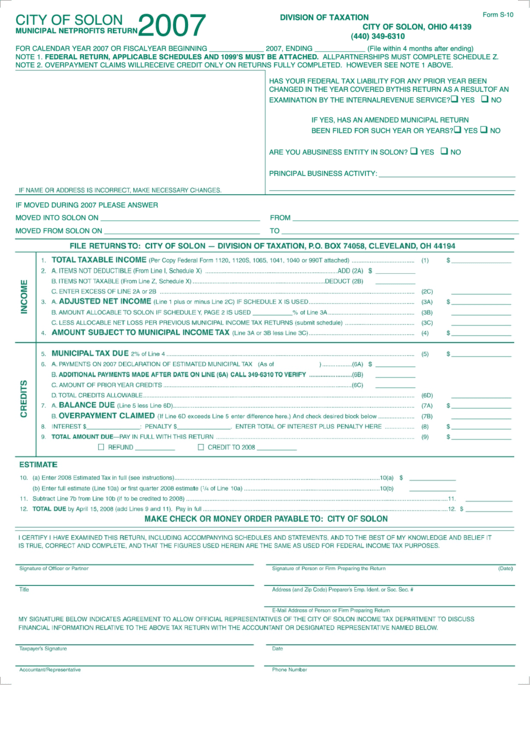

Form S-10 - Minucipal Profits Return - City Of Solon - 2007

ADVERTISEMENT

Form S-10

2007

CITY OF SOLON

DIVISION OF TAXATION

CITY OF SOLON, OHIO 44139

MUNICIPAL NET PROFITS RETURN

(440) 349-6310

FOR CALENDAR YEAR 2007 OR FISCAL YEAR BEGINNING ______________ 2007, ENDING _____________ (File within 4 months after ending)

NOTE 1. FEDERAL RETURN, APPLICABLE SCHEDULES AND 1099’S MUST BE ATTACHED. ALL PARTNERSHIPS MUST COMPLETE SCHEDULE Z.

NOTE 2. OVERPAYMENT CLAIMS WILL RECEIVE CREDIT ONLY ON RETURNS FULLY COMPLETED. HOWEVER SEE NOTE 1 ABOVE.

HAS YOUR FEDERAL TAX LIABILITY FOR ANY PRIOR YEAR BEEN

CHANGED IN THE YEAR COVERED BY THIS RETURN AS A RESULT OF AN

EXAMINATION BY THE INTERNAL REVENUE SERVICE?

YES

NO

IF YES, HAS AN AMENDED MUNICIPAL RETURN

BEEN FILED FOR SUCH YEAR OR YEARS?

YES

NO

ARE YOU A BUSINESS ENTITY IN SOLON?

YES

NO

PRINCIPAL BUSINESS ACTIVITY:

IF MOVED DURING 2007 PLEASE ANSWER

MOVED INTO SOLON ON _________________________________________

FROM __________________________________________________________

MOVED FROM SOLON ON ________________________________________

TO _____________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2