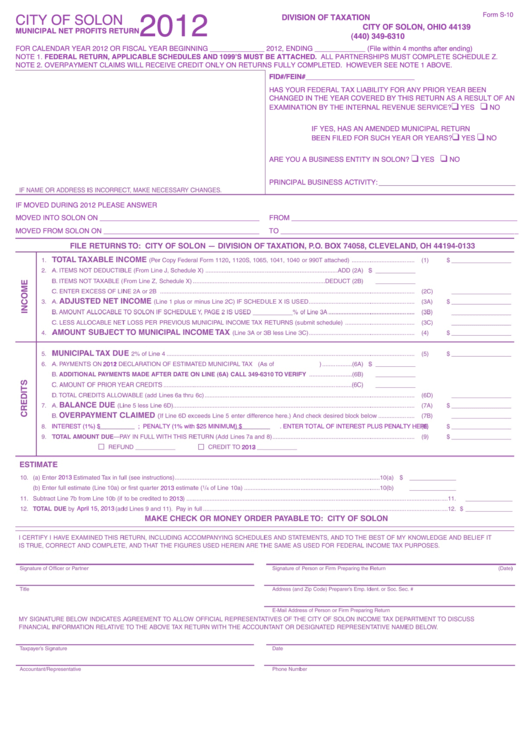

Form S-10 - Minucipal Profits Return - City Of Solon - 2012

ADVERTISEMENT

2012

CITY OF SOLON

Form S-10

DIVISION OF TAXATION

CITY OF SOLON, OHIO 44139

MUNICIPAL NET PROFITS RETURN

(440) 349-6310

FOR CALENDAR YEAR 2012 OR FISCAL YEAR BEGINNING ______________ 2012, ENDING _____________ (File within 4 months after ending)

NOTE 1. FEDERAL RETURN, APPLICABLE SCHEDULES AND 1099ʼS MUST BE ATTACHED. ALL PARTNERSHIPS MUST COMPLETE SCHEDULE Z.

NOTE 2. OVERPAYMENT CLAIMS WILL RECEIVE CREDIT ONLY ON RETURNS FULLY COMPLETED. HOWEVER SEE NOTE 1 ABOVE.

FID#/FEIN#____________________________

HAS YOUR FEDERAL TAX LIABILITY FOR ANY PRIOR YEAR BEEN

CHANGED IN THE YEAR COVERED BY THIS RETURN AS A RESULT OF AN

EXAMINATION BY THE INTERNAL REVENUE SERVICE?

❑

YES

❑

NO

IF YES, HAS AN AMENDED MUNICIPAL RETURN

BEEN FILED FOR SUCH YEAR OR YEARS?

❑

YES

❑

NO

ARE YOU A BUSINESS ENTITY IN SOLON?

❑

YES

❑

NO

PRINCIPAL BUSINESS ACTIVITY:

IF MOVED DURING 2012 PLEASE ANSWER

MOVED INTO SOLON ON _________________________________________

FROM __________________________________________________________

MOVED FROM SOLON ON ________________________________________

TO _____________________________________________________________

2011

2012

INTEREST (1%) $

; PENALTY (1% with $25 MINIMUM) $

. ENTER TOTAL OF INTEREST PLUS PENALTY HERE

2012

2013

2013

2013

April 15, 2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2