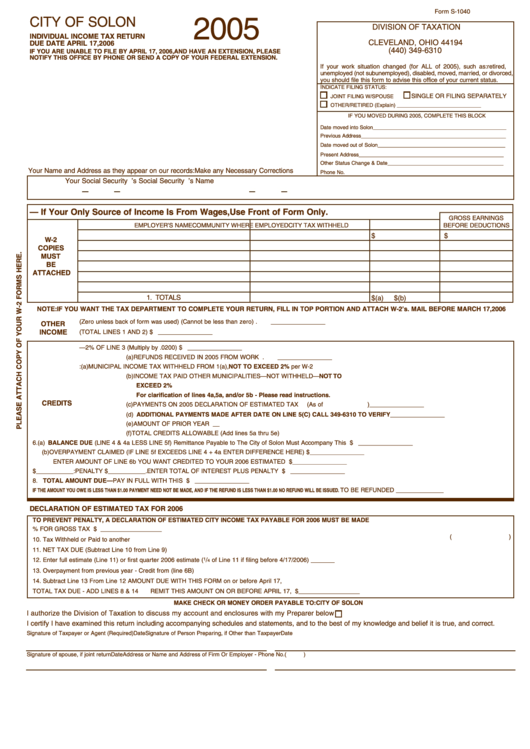

Form S-1040 - Individual Income Tax Return - 2005

ADVERTISEMENT

Form S-1040

CITY OF SOLON

2005

DIVISION OF TAXATION

P.O. BOX 74058

INDIVIDUAL INCOME TAX RETURN

CLEVELAND, OHIO 44194

DUE DATE APRIL 17, 2006

(440) 349-6310

IF YOU ARE UNABLE TO FILE BY APRIL 17, 2006, AND HAVE AN EXTENSION, PLEASE

NOTIFY THIS OFFICE BY PHONE OR SEND A COPY OF YOUR FEDERAL EXTENSION.

If your work situation changed (for ALL of 2005), such as: retired,

unemployed (not subunemployed), disabled, moved, married, or divorced,

you should file this form to advise this office of your current status.

I

NDICATE FILING STATUS:

SINGLE OR FILING SEPARATELY

JOINT FILING W/SPOUSE

OTHER/RETIRED (Explain) _____________________________

IF YOU MOVED DURING 2005, COMPLETE THIS BLOCK

Date moved into Solon______________________________________________

Previous Address __________________________________________________

Date moved out of Solon ____________________________________________

Present Address __________________________________________________

Other Status Change & Date ________________________________________

Your Name and Address as they appear on our records: Make any Necessary Corrections

Phone No.

Your Social Security No.

Spouse’s Social Security No.

Spouse’s Name

1. WAGES — If Your Only Source of Income Is From Wages, Use Front of Form Only.

GROSS EARNINGS

EMPLOYER’S NAME

COMMUNITY WHERE EMPLOYED

CITY TAX WITHHELD

BEFORE DEDUCTIONS

$

$

W-2

COPIES

MUST

BE

ATTACHED

1. TOTALS

$

(a)

$

(b)

NOTE: IF YOU WANT THE TAX DEPARTMENT TO COMPLETE YOUR RETURN, FILL IN TOP PORTION AND ATTACH W-2’s. MAIL BEFORE MARCH 17, 2006

2. INCOME OTHER THAN WAGES FROM PAGE 2 (Zero unless back of form was used) (Cannot be less than zero) ............................

________________

OTHER

INCOME

3. TOTAL INCOME (TOTAL LINES 1 AND 2)................................................................................................................................................ $ ________________

4. MUNICIPAL INCOME TAX—2% OF LINE 3 (Multiply by .0200) .............................................................................................................. $ ________________

(a) REFUNDS RECEIVED IN 2005 FROM WORK MUNICIPALITIES ............................................................................

________________

5. CREDITS:

(a) MUNICIPAL INCOME TAX WITHHELD FROM 1(a), NOT TO EXCEED 2% per W-2 ............

________________

(b) INCOME TAX PAID OTHER MUNICIPALITIES—NOT WITHHELD—NOT TO ......................

________________

EXCEED 2%

For clarification of lines 4a, 5a, and/or 5b - Please read instructions.

CREDITS

(c) PAYMENTS ON 2005 DECLARATION OF ESTIMATED TAX

(As of

)

________________

(d) ADDITIONAL PAYMENTS MADE AFTER DATE ON LINE 5(C) CALL 349-6310 TO VERIFY

________________

(e) AMOUNT OF PRIOR YEAR CREDITS ..................................................................................

________________

(f) TOTAL CREDITS ALLOWABLE (Add lines 5a thru 5e) ..............................................................................................

________________

6. (a) BALANCE DUE (LINE 4 & 4a LESS LINE 5f) Remittance Payable to The City of Solon Must Accompany This Return............................................ $ ________________

(b) OVERPAYMENT CLAIMED (IF LINE 5f EXCEEDS LINE 4 + 4a ENTER DIFFERENCE HERE) .......................................... $ ________________

ENTER AMOUNT OF LINE 6b YOU WANT CREDITED TO YOUR 2006 ESTIMATED TAX .................................................. $ ________________

7. INTEREST $___________: PENALTY $___________. ENTER TOTAL OF INTEREST PLUS PENALTY HERE ............................................................ $ ________________

8. TOTAL AMOUNT DUE—PAY IN FULL WITH THIS RETURN ............................................................................................................................................ $ ________________

TO BE REFUNDED ______________

IF THE AMOUNT YOU OWE IS LESS THAN $1.00 PAYMENT NEED NOT BE MADE, AND IF THE REFUND IS LESS THAN $1.00 NO REFUND WILL BE ISSUED.

DECLARATION OF ESTIMATED TAX FOR 2006

TO PREVENT PENALTY, A DECLARATION OF ESTIMATED CITY INCOME TAX PAYABLE FOR 2006 MUST BE MADE

9. Total Estimated Income Subject to Tax ______________X TAX RATE of 2% FOR GROSS TAX OF ............................................................................ $ __________________

(

)

10. Tax Withheld or Paid to another city ................................................................................................................................................................................

__________________

11. NET TAX DUE (Subtract Line 10 from Line 9) ................................................................................................................................................................

__________________

12. Enter full estimate (Line 11) or first quarter 2006 estimate (

1

/

of Line 11 if filing before 4/17/2006)..............................................................................

__________________

4

13. Overpayment from previous year - Credit from (line 6B)..................................................................................................................................................

__________________

14. Subtract Line 13 From Line 12 AMOUNT DUE WITH THIS FORM on or before April 17, 2006 ....................................................................................

__________________

TOTAL TAX DUE - ADD LINES 8 & 14

REMIT THIS AMOUNT ON OR BEFORE APRIL 17, 2006.

PAY IN FULL $ __________________

MAKE CHECK OR MONEY ORDER PAYABLE TO: CITY OF SOLON

I authorize the Division of Taxation to discuss my account and enclosures with my Preparer below

I certify I have examined this return including accompanying schedules and statements, and to the best of my knowledge and belief it is true, and correct.

Signature of Taxpayer or Agent (Required)

Date

Signature of Person Preparing, if Other than Taxpayer

Date

Signature of spouse, if joint return

Date

Address or Name and Address of Firm Or Employer - Phone No. (

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2