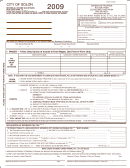

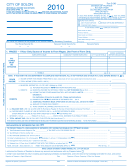

Form S-1040 - Individual Income Tax Return - 2005 Page 2

ADVERTISEMENT

WHEN SUBMITTING PLEASE ATTACH ALL FEDERAL SCHEDULES THAT APPLY

SCHEDULE C

PROFIT OR LOSS FROM BUSINESS OR PROFESSION

Business Name

Business Address

1. Net Profit or Loss........................................................................................................................................................................................

$

2. Add Items not Deductible (Schedule X Line D) ........................................................................................................................................

3. Deduct Items not Taxable (Schedule X Line F)..........................................................................................................................................

(

)

4. Adjusted Net Profit or Loss ........................................................................................................................................................................

$

5. Less allocable net loss carry-forward 5 year limit (See Instructions) ........................................................................................................

6. Net Profit or Loss (NET PROFIT ONLY, line 4 or line 6 enter on line 2, page 1) ......................................................................................

$

SCHEDULE G

INCOME FROM RENTS (Not included in Schedule C)

Type & address of property, City & State

NET INCOME (LOSS)

TENANT’S NAME

..................................................

$__________________

NET INCOME (or loss) SCHEDULE G

SCHEDULE H

PLEASE ATTACH K-1’s

ALL OTHER TAXABLE INCOME

INTEREST AND DIVIDENDS NOT TAXABLE

Individual’s distributive share of income from partnerships, estates, trust, director’s and other fees, farm and other sources (See Instructions)

Received From

Fed. I.D. #

For (Describe)

Amount

$

$_____________________

TOTAL INCOME SCHEDULE H

SCHEDULE X

ADJUSTMENT OF NET PROFIT OR LOSS LINE 1, SCHEDULE C ABOVE

TO EXCLUDE INCOME NOT TAXABLE, AND EXPENSES NOT ALLOWABLE

Schedule X entries are allowed only to the extent directly included in determination of net profits as shown on your Federal Return.

ITEMS NOT DEDUCTIBLE - ADD

ITEMS NOT TAXABLE - DEDUCT

$

$

A. Taxes based on Income ..................................................

E.

B. Contributions & Donations ..............................................

C. Other (explain)

D. TOTAL ADDITIONS (enter Line 2 Schedule C)..............

$

F. TOTAL DEDUCTIONS (enter Line 3, Schedule C) ........

$

DEDUCT

Loss carried forward from previous years if any—Attach Schedule

$ ________________

(

)

TOTAL

From Schedules C, G & H Enter on Page 1, Line 2 .................................................................

$ ________________

HELPFUL INFORMATION IS AVAILABLE FOR FILING THIS TAX RETURN AT THE TAX OFFICE

1.)

Solon allows a tax credit for taxes withheld and/or paid to another city or village up to and including the maximum rate of 2% per W-2.

2.)

Earned income is defined as salaries, wages, commissions, and other compensation and would include but not be limited to bonuses, incentive payments, director’s fees,

property in lieu of cash, tips, dismissal or severance pay, lotteries, contest prizes and awards, tax shelter plans, vacation and sick pay, wage continuation plans, supplemental

unemployment benefits, depreciation recapture and other compensation earned, received or accrued.

3.)

A business loss cannot be used against W-2 income. A business loss can be carried forward for a period of five years to offset a business gain.

4.)

Tax sheltered annuities, IRA, Keogh, all deferred income plans are not deductible from gross or net income.

5.)

Upon turning 18 years of age, you are required to file. If you are 17 years of age or under and city tax has been withheld from your wages for Solon, you may be eligible for a

refund.

6.)

All Solon residents with earned income, whether or not a tax is due, when turning 18 years of age are required to file an annual return with the Solon Income Tax Office.

Retired residents on social security and pensions only are not required to file - check with Tax Office.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2