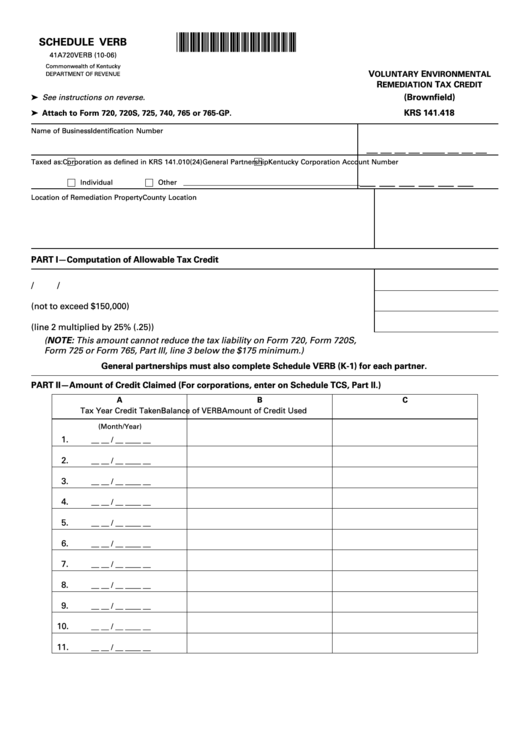

Form 41a720verb - Schedule Verb - Voluntary Environmental Remediation Tax Credit

ADVERTISEMENT

*0600010229*

SCHEDULE VERB

41A720VERB (10-06)

Commonwealth of Kentucky

V

E

OLUNTARY

NVIRONMENTAL

DEPARTMENT OF REVENUE

R

T

C

EMEDIATION

AX

REDIT

➤ See instructions on reverse.

(Brownfield)

➤ Attach to Form 720, 720S, 725, 740, 765 or 765-GP.

KRS 141.418

Name of Business

Identification Number

__ __ __ __ __ __ __ __ __

Taxed as:

Corporation as defined in KRS 141.010(24)

General Partnership

Kentucky Corporation Account Number

__ __ __ __ __ __

Individual

Other __________________________________________________

Location of Remediation Property

County Location

PART I—Computation of Allowable Tax Credit

/

/

1. Date certified ........................................................................................................... 1

2. Certified remediation expenditures (not to exceed $150,000) .............................. 2

3. Maximum allowable credit per tax year (line 2 multiplied by 25% (.25)) ............ 3

(NOTE: This amount cannot reduce the tax liability on Form 720, Form 720S,

Form 725 or Form 765, Part III, line 3 below the $175 minimum.)

General partnerships must also complete Schedule VERB (K-1) for each partner.

PART II—Amount of Credit Claimed (For corporations, enter on Schedule TCS, Part II.)

A

B

C

Tax Year Credit Taken

Balance of VERB

Amount of Credit Used

(Month/Year)

1.

__ __ / __ __ __ __

2.

__ __ / __ __ __ __

3.

__ __ / __ __ __ __

4.

__ __ / __ __ __ __

5.

__ __ / __ __ __ __

6.

__ __ / __ __ __ __

7.

__ __ / __ __ __ __

8.

__ __ / __ __ __ __

9.

__ __ / __ __ __ __

10.

__ __ / __ __ __ __

11.

__ __ / __ __ __ __

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1