Print and Reset Form

Reset Form

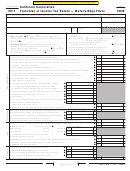

Schedule V Cost of Goods Sold

� Inventory at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

�

2 Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Cost of labor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 a Additional IRC Section 263A costs. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4a

b Other costs. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4b

5 Total. Add line 1 through line 4b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Cost of goods sold. Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

Method of inventory valuation _____________________________________________________________________________________________

Was there any change in determining quantities, costs of valuations between opening and closing inventory?

If “Yes,” attach an explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

Enter California seller’s permit number, if any _____________________________________________________________

Check if the LIFO inventory method was adopted this taxable year for any goods. If checked, attach federal Form 970 . . . . . . . . . . . . . . . . . . . . . . . . .

If the LIFO inventory method was used for this taxable year, enter the amount of closing inventory under LIFO__________________________________

Do the rules of IRC Section 263A (with respect to property produced or acquired for resale) apply to the corporation? . . . . . . . . . . . . . . . Yes No

The corporation may not be required to complete Schedules l, M-� and M-2 . See Schedule M-� instructions for reporting requirements .

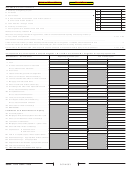

Schedule L

Balance Sheet

Beginning of taxable year

End of taxable year

Assets

(a)

(b)

(c)

(d)

� Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 a Trade notes and accounts receivable . . . . . . . . .

(

)

(

)

b Less allowance for bad debts . . . . . . . . . . . . . . .

3 Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Federal and state government obligations . . . . . . .

5 Other current assets. Attach schedule(s) . . . . . . . .

6 Loans to stockholders/officers. Attach schedule . .

7 Mortgage and real estate loans. . . . . . . . . . . . . . . .

8 Other investments. Attach schedule(s) . . . . . . . . . .

9 a Buildings and other fixed depreciable assets . . .

(

)

(

)

b Less accumulated depreciation. . . . . . . . . . . . . .

�0 a Depletable assets . . . . . . . . . . . . . . . . . . . . . . . .

(

)

(

)

b Less accumulated depletion . . . . . . . . . . . . . . . .

�� Land (net of any amortization) . . . . . . . . . . . . . . . .

�2 a Intangible assets (amortizable only) . . . . . . . . . .

(

)

(

)

b Less accumulated amortization. . . . . . . . . . . . . .

�3 Other assets. Attach schedule(s) . . . . . . . . . . . . . .

�4 Total assets.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Liabilities and Stockholders’ Equity

�5 Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . .

�6

Mortgages, notes, bonds payable in less than 1 year

�7 Other current liabilities. Attach schedule(s) . . . . . .

�8 Loans from stockholders . . . . . . . . . . . . . . . . . . . .

�9

Mortgages, notes, bonds payable in 1 year or more

20 Other liabilities. Attach schedule(s) . . . . . . . . . . . .

2� Capital stock: a Preferred stock. . . . . . . . . . . . . .

b Common stock . . . . . . . . . . . . . .

22 Paid-in or capital surplus. Attach reconciliation . . .

23 Retained earnings – Appropriated. Attach schedule

24 Retained earnings – Unappropriated . . . . . . . . . . .

25

Adjustments to shareholders’ equity. Attach schedule

(

)

(

)

26 Less cost of treasury stock. . . . . . . . . . . . . . . . . . .

27 Total liabilities and stockholders’ equity . . . . . . .

Side 4 Form 100W

2006

3624063

C1

1

1 2

2 3

3 4

4 5

5