Colorado Form 105-Ep - Estate/trust Estimated Tax Payment Voucher - 2010

ADVERTISEMENT

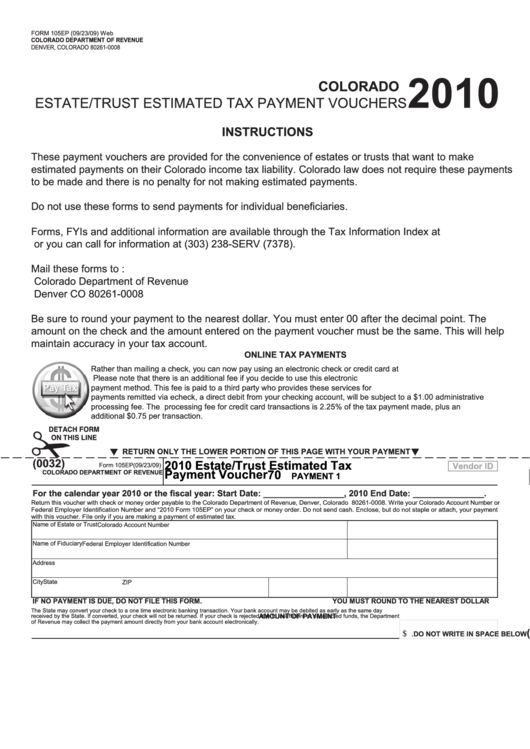

ForM 105eP (09/23/09) Web

colorado department of revenue

denver, colorado 80261-0008

2010

colorado

estate/trust estIMated taX PaYMent voucHers

InStructIonS

these payment vouchers are provided for the convenience of estates or trusts that want to make

estimated payments on their colorado income tax liability. colorado law does not require these payments

to be made and there is no penalty for not making estimated payments.

Do not use these forms to send payments for individual beneficiaries.

Forms, FYIs and additional information are available through the tax Information Index at

or you can call for information at (303) 238-serv (7378).

Mail these forms to :

colorado department of revenue

denver co 80261-0008

Be sure to round your payment to the nearest dollar. You must enter 00 after the decimal point. the

amount on the check and the amount entered on the payment voucher must be the same. this will help

maintain accuracy in your tax account.

onlIne tax paymentS

rather

than

mailing

a

check,

you

can

now

pay

using

an

electronic

check

or

credit

card

at

Please note that there is an additional fee if you decide to use this electronic

payment method. this fee is paid to a third party who provides these services for colorado.gov. tax

payments remitted via echeck, a direct debit from your checking account, will be subject to a $1.00 administrative

processing fee. the processing fee for credit card transactions is 2.25% of the tax payment made, plus an

additional $0.75 per transaction.

DETACH FORM

ON THIS LINE

return only the loWer portIon of thIS paGe WIth your payment

(0032)

2010 estate/trust estimated tax

vendor Id

Form 105eP (09/23/09)

colorado department of revenue

payment voucher

70

payment 1

For the calendar year 2010 or the fiscal year: Start Date: _________________ , 2010 End Date: _______________.

return this voucher with check or money order payable to the colorado department of revenue, denver, colorado 80261-0008. Write your colorado account number or

Federal Employer Identification Number and “2010 Form 105EP” on your check or money order. Do not send cash. Enclose, but do not staple or attach, your payment

with this voucher. File only if you are making a payment of estimated tax.

name of estate or trust

colorado account number

name of Fiduciary

Federal Employer Identification Number

address

city

state

ZIP

If no payment IS due, do not fIle thIS form.

you muSt round to the neareSt dollar

the state may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day

amount of payment

received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department

of revenue may collect the payment amount directly from your bank account electronically.

$

.

(08)

do not WrIte In Space BeloW

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4