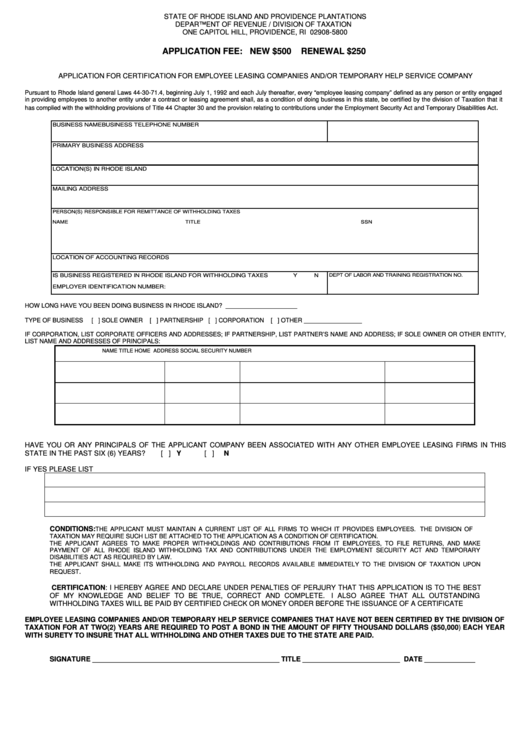

Application For Certification For Employee Leasing Companies And/or Temporary Help Service Company

ADVERTISEMENT

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

DEPARTMENT OF REVENUE / DIVISION OF TAXATION

ONE CAPITOL HILL, PROVIDENCE, RI 02908-5800

APPLICATION FEE: NEW $500

RENEWAL $250

APPLICATION FOR CERTIFICATION FOR EMPLOYEE LEASING COMPANIES AND/OR TEMPORARY HELP SERVICE COMPANY

Pursuant to Rhode Island general Laws 44-30-71.4, beginning July 1, 1992 and each July thereafter, every “employee leasing company” defined as any person or entity engaged

in providing employees to another entity under a contract or leasing agreement shall, as a condition of doing business in this state, be certified by the division of Taxation that it

.

has complied with the withholding provisions of Title 44 Chapter 30 and the provision relating to contributions under the Employment Security Act and Temporary Disabilities Act

BUSINESS NAME

BUSINESS TELEPHONE NUMBER

PRIMARY BUSINESS ADDRESS

LOCATION(S) IN RHODE ISLAND

MAILING ADDRESS

PERSON(S) RESPONSIBLE FOR REMITTANCE OF WITHHOLDING TAXES

NAME

TITLE

SSN

LOCATION OF ACCOUNTING RECORDS

IS BUSINESS REGISTERED IN RHODE ISLAND FOR WITHHOLDING TAXES

Y

N

DEPT OF LABOR AND TRAINING REGISTRATION NO.

EMPLOYER IDENTIFICATION NUMBER:

HOW LONG HAVE YOU BEEN DOING BUSINESS IN RHODE ISLAND? _____________________

TYPE OF BUSINESS

[ ] SOLE OWNER

[ ] PARTNERSHIP [ ] CORPORATION

[ ] OTHER _________________

IF CORPORATION, LIST CORPORATE OFFICERS AND ADDRESSES; IF PARTNERSHIP, LIST PARTNER’S NAME AND ADDRESS; IF SOLE OWNER OR OTHER ENTITY,

LIST NAME AND ADDRESSES OF PRINCIPALS:

NAME

TITLE

HOME ADDRESS

SOCIAL SECURITY NUMBER

HAVE YOU OR ANY PRINCIPALS OF THE APPLICANT COMPANY BEEN ASSOCIATED WITH ANY OTHER EMPLOYEE LEASING FIRMS IN THIS

STATE IN THE PAST SIX (6) YEARS?

[ ] Y

[ ]

N

IF YES PLEASE LIST

CONDITIONS:

THE APPLICANT MUST MAINTAIN A CURRENT LIST OF ALL FIRMS TO WHICH IT PROVIDES EMPLOYEES. THE DIVISION OF

TAXATION MAY REQUIRE SUCH LIST BE ATTACHED TO THE APPLICATION AS A CONDITION OF CERTIFICATION.

THE APPLICANT AGREES TO MAKE PROPER WITHHOLDINGS AND CONTRIBUTIONS FROM IT EMPLOYEES, TO FILE RETURNS, AND MAKE

PAYMENT OF ALL RHODE ISLAND WITHHOLDING TAX AND CONTRIBUTIONS UNDER THE EMPLOYMENT SECURITY ACT AND TEMPORARY

DISABILITIES ACT AS REQUIRED BY LAW.

THE APPLICANT SHALL MAKE ITS WITHHOLDING AND PAYROLL RECORDS AVAILABLE IMMEDIATELY TO THE DIVISION OF TAXATION UPON

.

REQUEST

CERTIFICATION: I HEREBY AGREE AND DECLARE UNDER PENALTIES OF PERJURY THAT THIS APPLICATION IS TO THE BEST

OF MY KNOWLEDGE AND BELIEF TO BE TRUE, CORRECT AND COMPLETE.

I ALSO AGREE THAT ALL OUTSTANDING

WITHHOLDING TAXES WILL BE PAID BY CERTIFIED CHECK OR MONEY ORDER BEFORE THE ISSUANCE OF A CERTIFICATE

EMPLOYEE LEASING COMPANIES AND/OR TEMPORARY HELP SERVICE COMPANIES THAT HAVE NOT BEEN CERTIFIED BY THE DIVISION OF

TAXATION FOR AT TWO(2) YEARS ARE REQUIRED TO POST A BOND IN THE AMOUNT OF FIFTY THOUSAND DOLLARS ($50,000) EACH YEAR

WITH SURETY TO INSURE THAT ALL WITHHOLDING AND OTHER TAXES DUE TO THE STATE ARE PAID.

SIGNATURE ________________________________________________ TITLE _________________________ DATE _____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1