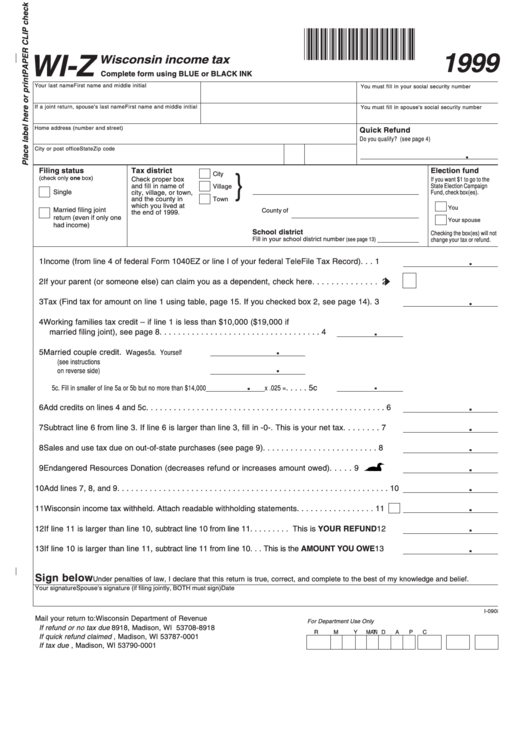

Form Wi-Z - Wisconsin Income Tax - Wisconsin Department Of Revenue - 1999

ADVERTISEMENT

*I10499991*

1999

WI-Z

Wisconsin income tax

Complete form using BLUE or BLACK INK

Your last name

First name and middle initial

You must fill in your social security number

If a joint return, spouse's last name

First name and middle initial

You must fill in spouse's social security number

Home address (number and street)

Quick Refund

Do you qualify? (see page 4)

City or post office

State

Zip code

.

Filing status

Tax district

Election fund

City

}

(check only one box)

Check proper box

If you want $1 to go to the

and fill in name of

State Election Campaign

Village

Single

city, village, or town,

Fund, check box(es).

and the county in

Town

which you lived at

You

Married filing joint

County of

the end of 1999.

return (even if only one

Your spouse

had income)

School district

Checking the box(es) will not

Fill in your school district number

(see page 13)

change your tax or refund.

.

1 Income (from line 4 of federal Form 1040EZ or line I of your federal TeleFile Tax Record) . . .

1

2 If your parent (or someone else) can claim you as a dependent, check here . . . . . . . . . . . . . .

2

.

3 Tax (Find tax for amount on line 1 using table, page 15. If you checked box 2, see page 14) .

3

4 Working families tax credit – if line 1 is less than $10,000 ($19,000 if

.

married filing joint), see page 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.

5 Married couple credit.

Wages 5a. Yourself .......

(see instructions

.

on reverse side)

5b. Spouse ........

.

.

. . . . .

5c

5c. Fill in smaller of line 5a or 5b but no more than $14,000 __________________ x .025 =

.

6 Add credits on lines 4 and 5c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

.

7 Subtract line 6 from line 3. If line 6 is larger than line 3, fill in -0-. This is your net tax . . . . . . . .

7

.

8 Sales and use tax due on out-of-state purchases (see page 9) . . . . . . . . . . . . . . . . . . . . . . . . .

8

.

9 Endangered Resources Donation (decreases refund or increases amount owed) . . . . .

9

.

10 Add lines 7, 8, and 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.

11 Wisconsin income tax withheld. Attach readable withholding statements . . . . . . . . . . . . . . . . . 11

.

12 If line 11 is larger than line 10, subtract line 10 from line 11 . . . . . . . . . This is YOUR REFUND 12

.

13 If line 10 is larger than line 11, subtract line 11 from line 10 . . . This is the AMOUNT YOU OWE 13

Sign below

Under penalties of law, I declare that this return is true, correct, and complete to the best of my knowledge and belief.

Your signature

Spouse's signature (if filing jointly, BOTH must sign)

Date

I-090i

Mail your return to:

Wisconsin Department of Revenue

For Department Use Only

If refund or no tax due ........ P.O. Box 8918, Madison, WI 53708-8918

R

M

Y

T MAN D

A

P

C

If quick refund claimed ....... P.O. Box 38, Madison, WI 53787-0001

If tax due ............................. P.O. Box 268, Madison, WI 53790-0001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1