Form S-013 - Concessionaire/temporary Permittee Annual Sales And Use Tax Return - Wisconsin Department Of Revenue -1999

ADVERTISEMENT

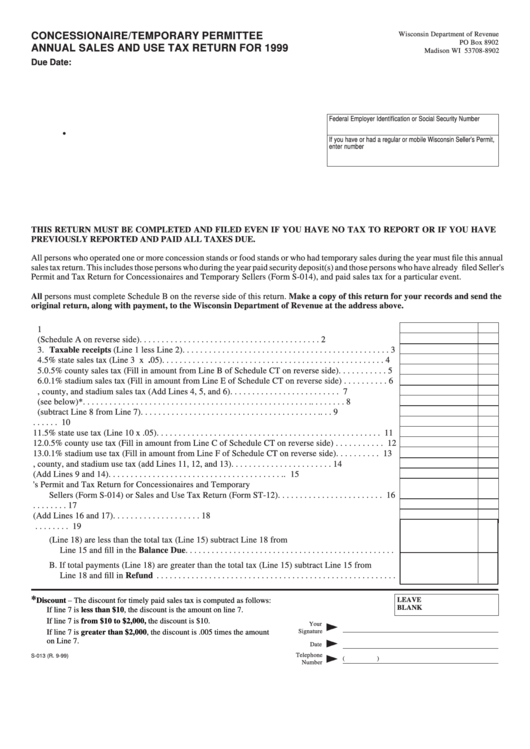

CONCESSIONAIRE/TEMPORARY PERMITTEE

Wisconsin Department of Revenue

PO Box 8902

ANNUAL SALES AND USE TAX RETURN FOR 1999

Madison WI 53708-8902

Due Date:

Federal Employer Identification or Social Security Number

.

If you have or had a regular or mobile Wisconsin Seller’s Permit,

enter number

THIS RETURN MUST BE COMPLETED AND FILED EVEN IF YOU HAVE NO TAX TO REPORT OR IF YOU HAVE

PREVIOUSLY REPORTED AND PAID ALL TAXES DUE.

All persons who operated one or more concession stands or food stands or who had temporary sales during the year must file this annual

sales tax return. This includes those persons who during the year paid security deposit(s) and those persons who have already filed Seller's

Permit and Tax Return for Concessionaires and Temporary Sellers (Form S-014), and paid sales tax for a particular event.

All persons must complete Schedule B on the reverse side of this return. Make a copy of this return for your records and send the

original return, along with payment, to the Wisconsin Department of Revenue at the address above.

1. Total gross receipts from Wisconsin sales in 1999 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2. Less deductions (Schedule A on reverse side) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3. Taxable receipts (Line 1 less Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4. 5% state sales tax (Line 3 x .05) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5. 0.5% county sales tax (Fill in amount from Line B of Schedule CT on reverse side) . . . . . . . . . . . 5

6. 0.1% stadium sales tax (Fill in amount from Line E of Schedule CT on reverse side) . . . . . . . . . . 6

7. Total state, county, and stadium sales tax (Add Lines 4, 5, and 6) . . . . . . . . . . . . . . . . . . . . . . . . . 7

8. Discount (see below)* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9. Net sales tax (subtract Line 8 from Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10. Purchases subject to use tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11. 5% state use tax (Line 10 x .05) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12. 0.5% county use tax (Fill in amount from Line C of Schedule CT on reverse side) . . . . . . . . . . . 12

13. 0.1% stadium use tax (Fill in amount from Line F of Schedule CT on reverse side) . . . . . . . . . . 13

14. Total state, county, and stadium use tax (add Lines 11, 12, and 13) . . . . . . . . . . . . . . . . . . . . . . . 14

15. Total sales and use tax (Add Lines 9 and 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16. Tax previously paid on Seller's Permit and Tax Return for Concessionaires and Temporary

Sellers (Form S-014) or Sales and Use Tax Return (Form ST-12) . . . . . . . . . . . . . . . . . . . . . . . . 16

17. Security deposits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18. Total tax previously paid and security deposits (Add Lines 16 and 17) . . . . . . . . . . . . . . . . . . . . 18

19. Tax due or refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

A. If total payments (Line 18) are less than the total tax (Line 15) subtract Line 18 from

Line 15 and fill in the Balance Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B. If total payments (Line 18) are greater than the total tax (Line 15) subtract Line 15 from

Line 18 and fill in Refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

*

LEAVE

Discount – The discount for timely paid sales tax is computed as follows:

BLANK

If line 7 is less than $10, the discount is the amount on line 7.

If line 7 is from $10 to $2,000, the discount is $10.

Your

Signature

If line 7 is greater than $2,000, the discount is .005 times the amount

on Line 7.

Date

Telephone

S-013 (R. 9-99)

(

)

Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2