Instructions For Form 2555 - Foreign Earned Income - Internal Revenue Service - 2007 Page 3

ADVERTISEMENT

•

business premises. In addition, you must

second foreign household as defined

Each spouse’s household was not

have been required to accept the lodging

later), and

within a reasonable commuting distance

•

as a condition of your employment. If you

You meet the tax home test and either

of the other spouse’s tax home.

lived in a camp provided by, or on behalf

the bona fide residence or physical

Otherwise, only one spouse can claim

of, your employer, the camp may be

presence test.

his or her housing exclusion or deduction.

considered part of your employer’s

This is true even if you and your spouse

Second foreign household. If you

business premises. See Exclusion of

file separate returns.

maintained a separate foreign household

Meals and Lodging in Pub. 54 for details.

for your spouse and dependents at a

See Pub. 54 for additional information.

place other than your tax home because

Line 29a. Enter the city or other location

Part VI

the living conditions at your tax home

(if applicable) and the country where you

were dangerous, unhealthful, or otherwise

incurred foreign housing expenses during

Line 28. Enter the total reasonable

adverse, you can include the expenses of

the tax year only if your location is listed

expenses paid or incurred during the tax

the second household on line 28.

in the table beginning on page 5;

year by you, or on your behalf, for your

Married couples. The following rules

otherwise, leave this line blank.

foreign housing and the housing of your

apply if both you and your spouse qualify

spouse and dependents if they lived with

Line 29b. Your housing expenses may

for the tax benefits of Form 2555.

you. You can also include the reasonable

not exceed a certain limit. The limit on

expenses of a second foreign household

housing expenses varies depending upon

Same foreign household. If you and

(defined later). Housing expenses are

your spouse lived in the same foreign

the location in which you incur housing

considered reasonable to the extent they

expenses. In 2007, for most locations,

household and file a joint return, you must

are not lavish or extravagant under the

this limit is $25,710 (30 percent of

figure your housing amounts (line 33)

circumstances.

$85,700) if your qualifying period includes

jointly. If you file separate returns, only

all of 2007 (or $70.44 per day if the

one spouse can claim the housing

Housing expenses include rent, utilities

number of days in your qualifying period

exclusion or deduction.

(other than telephone charges), real and

that fall within your 2007 tax year is less

personal property insurance,

In figuring your housing amount

than 365).

nonrefundable fees paid to obtain a lease,

jointly, either spouse (but not both) can

The table beginning on page 5 lists the

rental of furniture and accessories,

claim the housing exclusion or housing

housing expense limits based on

residential parking, and household

deduction. However, if you and your

geographic differences in foreign housing

repairs. You can also include the fair

spouse have different periods of

costs relative to housing costs in the

residence or presence, and the one with

rental value of housing provided by, or on

United States. If the location in which you

behalf of, your employer if you have not

the shorter period of residence or

incurred housing expenses is listed in the

excluded it on line 25.

presence claims the exclusion or

table, or the number of days in your

deduction, you can claim as housing

Do not include deductible interest and

qualifying period that fall within the 2007

expenses only the expenses for that

taxes, any amount deductible by a

tax year is less than 365, use the Limit on

shorter period. The spouse claiming the

tenant-stockholder in connection with

Housing Expenses Worksheet on this

exclusion or deduction can aggregate the

cooperative housing, the cost of buying or

page to figure the amount to enter on line

housing expenses of both spouses,

improving a house, principal payments on

29b. If the location in which you incurred

subject to the limit on housing expenses

a mortgage, or depreciation on the house.

housing expenses is not listed in the

(line 29b), and subtract his or her base

Also, do not include the cost of domestic

table, and the number of days in your

housing amount.

labor, pay television, or the cost of buying

qualifying period is 365, enter $25,710 on

Separate foreign households. If you

furniture or accessories.

line 29b.

and your spouse lived in separate foreign

Example. For 2007, because your

Include expenses for housing only

households, you each can claim qualified

location is not listed in the table beginning

during periods for which:

expenses for your own household only if:

•

•

on page 5, your limit on housing

The value of your housing is not

Your tax homes were not within a

expenses is $70.44 per day ($25,710

excluded from gross income under

reasonable commuting distance of each

divided by 365). If you file a calendar year

section 119 (unless you maintained a

other, and

return and your qualifying period is

January 1, 2007, to September 30, 2007

(273 days), you would enter $19,230 on

line 29b ($70.44 mutiplied by 273 days).

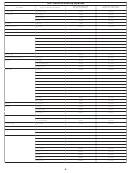

Limit on Housing Expenses Worksheet —

More than one foreign location. If

Line 29b

Keep for Your Records

you moved during the 2007 tax year and

incurred housing expenses in more than

one foreign location as a result, complete

Note. If the location in which you incurred housing expenses is not listed in the table

the Limit on Housing Expenses

beginning on page 5, and the number of days in your qualifying period that fall within the

Worksheet on this page for each location

2007 tax year is 365, DO NOT complete this worksheet. Instead, enter $25,710 on line 29b.

in which you incurred housing expenses,

entering the number of qualifying days

during which you lived in the applicable

1. Enter the number of days in your qualifying period that fall within the

location on line 1. Add the results shown

2007 tax year (see the instructions for line 31) . . . . . . . . . . . . . . .

1.

on line 4 of each worksheet, and enter the

total on line 29b.

2. Did you enter 365 on line 1?

If you moved during the 2007 tax

No. If the amount on line 1 is less than 365, skip line 2 and go to

!

year and are completing more

line 3.

than one Limit on Housing

CAUTION

Expenses Worksheet, the total number of

Yes. Locate the amount under the column Limit on Housing

days entered on line 1 of your worksheets

Expenses (full year) from the table beginning on page 5 for the

may not exceed the total number of days

location in which you incurred housing expenses. This is your

in your qualifying period that fall within the

limit on housing expenses. Enter the amount here and on

2007 tax year (that is, the number of days

line 29b.

entered on Form 2555, line 31).

Line 31. Enter the number of days in

STOP

Do not complete the rest of this worksheet . . . . . . . . . . . .

2.

your qualifying period that fall within your

2007 tax year. Your qualifying period is

3. Enter the amount under the column Limit on Housing Expenses

the period during which you meet the tax

(daily) from the table beginning on page 5 for the location in which

home test and either the bona fide

you incurred housing expenses. If the location is not listed in the

residence or the physical presence test.

table, enter $70.44 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Example. You establish a tax home

and bona fide residence in a foreign

4. Multiply line 1 by line 3. This is your limit on housing expenses.

country on August 14, 2007. You maintain

Enter the result here and on line 29b . . . . . . . . . . . . . . . . . . . . .

4.

the tax home and residence until January

31, 2009. You are a calendar year

-3-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11