Instructions For Claim For Refund

ADVERTISEMENT

Instructions for Claim for Refund

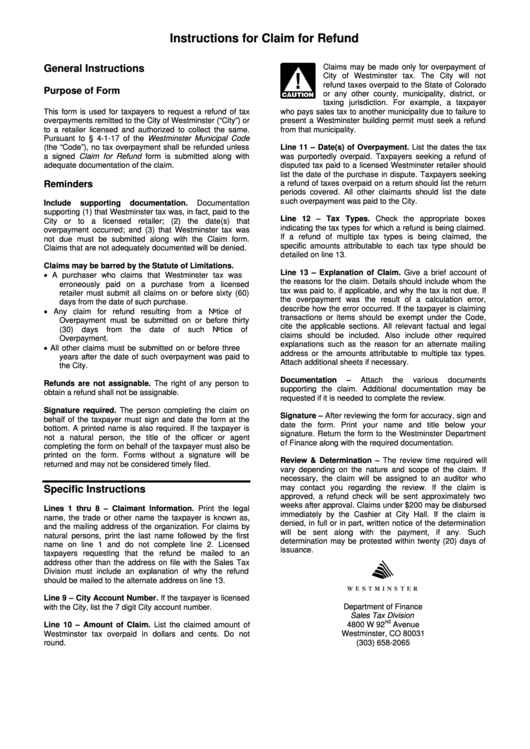

Claims may be made only for overpayment of

General Instructions

City of Westminster tax. The City will not

refund taxes overpaid to the State of Colorado

Purpose of Form

or any other county, municipality, district, or

taxing jurisdiction. For example, a taxpayer

This form is used for taxpayers to request a refund of tax

who pays sales tax to another municipality due to failure to

overpayments remitted to the City of Westminster (“City”) or

present a Westminster building permit must seek a refund

to a retailer licensed and authorized to collect the same.

fr

om that municipality.

Pursuant to § 4-1-17 of the Westminster Municipal Code

(the “Code”), no tax overpayment shall be refunded unless

Line 11 – Date(s) of Overpayment. List the dates the tax

a signed Claim for Refund form is submitted along with

was purportedly overpaid. Taxpayers seeking a refund of

adequate documentation of the claim.

disputed tax paid to a licensed Westminster retailer should

list the date of the purchase in dispute. Taxpayers seeking

a refund of taxes overpaid on a return should list the return

Reminders

periods covered. All other claimants sh

ould list the date

s

uch overpayment was paid to the City.

Include

supporting

documentation.

Documentation

supporting (1) that Westminster tax was, in fact, paid to the

Line 12 – Tax Types. Check the appropriate boxes

City or to a licensed retailer; (2) the date(s) that

indicating the tax types for which a refund is being claimed.

overpayment occurred; and (3) that Westminster tax was

If a refund of multiple tax types is being claimed, the

not due must be submitted along with the Claim form.

specific amounts at

tributable to each tax type should be

Claims that are not adequately documented will be denied.

d

etailed on line 13.

Claims may be barred by the Statute of Limitations.

Line 13 – Explanation of Claim. Give a brief account of

A purchaser who claims that Westminster tax was

the reasons for the claim. Details should include whom the

erroneously paid on a purchase from a licensed

tax was paid to, if applicable, and why the tax is not due. If

retailer must submit all claims on or before sixty (60)

the overpayment was the result of a calculation error,

days from the date of such purchase.

describe how the error occurred. If the taxpayer is claiming

Any claim for refund resulting from a Notice of

transactions or items should be exempt under the Code,

Overpayment must be submitted on or before thirty

cite the applicable sections. All relevant factual and legal

(30)

days

from

the

date

of

such

Notice

of

claims should be included. Also include other required

Overpayment.

explanations such as the reason for an alternate mailing

All other claims must be submitted on or before three

address or the amounts attributable t

o multiple tax types.

years after the date of such overpayment was paid to

A

ttach additional sheets if necessary.

the City.

Documentation

–

Attach

the

various

documents

Refunds are not assignable. The right of any person to

supporting the claim. Additional documentation

may be

obtain a refund shall not be assignable.

re

quested if it is needed to complete the review.

Signature required. The person completing the claim on

Signature – After reviewing the form for accuracy, sign and

behalf of the taxpayer must sign and date the form at the

date the form. Print your name and title below your

bottom. A printed name is also required. If the taxpayer is

signature. Return the form to the Westminster Dep

artment

not a natural person, the title of the officer or agent

o

f Finance along with the required documentation.

completing the form on behalf of the taxpayer must also be

printed on the form. Forms without a signature will be

Review & Determination – The review time required will

returned and may not be considered timely filed.

vary depending on the nature and scope of the claim. If

necessary, the claim will be assigned to an auditor who

may contact you regarding the review. If the claim is

Specific Instructions

approved, a refund check will be sent approximately two

weeks after approval. Claims under $200 may be disbursed

Lines 1 thru 8 – Claimant Information. Print the legal

immediately by the Cashier at City Hall. If the claim is

name, the trade or other name the taxpayer is known as,

denied, in full or in part, written notice of the determination

and the mailing address of the organization. For claims by

will be sent along with the payment, if any. Such

natural persons, print the last name followed by the first

determinati

on may be protested within twenty (20) days of

name on line 1 and do not complete line 2. Licensed

is

suance.

taxpayers requesting that the refund be mailed to an

address other than the address on file with the Sales Tax

Division must include an explanation of why the refund

should be mailed to the alternate address on line 13.

Line 9 – City Account Number. If the taxpayer is licensed

D

epartment of Finance

with the City, list the 7 digit City account number.

Sales Tax Division

nd

Line 10 – Amount of Claim. List the claimed amount of

4800 W 92

Avenue

Westminster, CO 80031

Westminster tax overpaid in dollars and cents. Do not

(303) 658-2065

round.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1