Form De 938p - Instructions For Completing The Claim For Adjustment Or Refund Of Personal Income Tax Form

ADVERTISEMENT

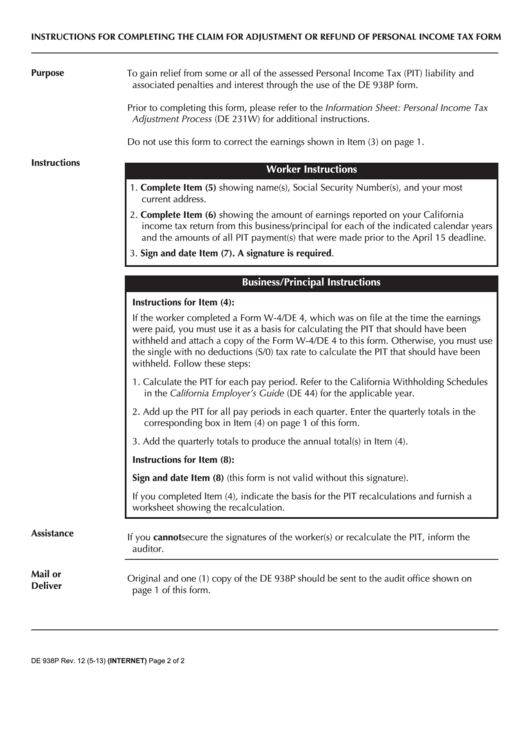

INSTRUCTIONS FOR COMPLETING THE CLAIM FOR ADJUSTMENT OR REFUND OF PERSONAL INCOME TAX FORM

Purpose

To gain relief from some or all of the assessed Personal Income Tax (PIT) liability and

associated penalties and interest through the use of the DE 938P form.

Prior to completing this form, please refer to the Information Sheet: Personal Income Tax

Adjustment Process (DE 231W) for additional instructions.

Do not use this form to correct the earnings shown in Item (3) on page 1.

Instructions

Worker Instructions

1. Complete Item (5) showing name(s), Social Security Number(s), and your most

current address.

2. Complete Item (6) showing the amount of earnings reported on your California

income tax return from this business/principal for each of the indicated calendar years

and the amounts of all PIT payment(s) that were made prior to the April 15 deadline.

3. Sign and date Item (7). A signature is required.

Business/Principal Instructions

Instructions for Item (4):

If the worker completed a Form W-4/DE 4, which was on file at the time the earnings

were paid, you must use it as a basis for calculating the PIT that should have been

withheld and attach a copy of the Form W-4/DE 4 to this form. Otherwise, you must use

the single with no deductions (S/0) tax rate to calculate the PIT that should have been

withheld. Follow these steps:

1. Calculate the PIT for each pay period. Refer to the California Withholding Schedules

in the California Employer’s Guide (DE 44) for the applicable year.

2. Add up the PIT for all pay periods in each quarter. Enter the quarterly totals in the

corresponding box in Item (4) on page 1 of this form.

3. Add the quarterly totals to produce the annual total(s) in Item (4).

Instructions for Item (8):

Sign and date Item (8) (this form is not valid without this signature).

If you completed Item (4), indicate the basis for the PIT recalculations and furnish a

worksheet showing the recalculation.

Assistance

If you cannot secure the signatures of the worker(s) or recalculate the PIT, inform the

auditor.

Mail or

Original and one (1) copy of the DE 938P should be sent to the audit office shown on

Deliver

page 1 of this form.

DE 938P Rev. 12 (5-13) (INTERNET)

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1