Instructions For Individual Income Tax Return And Declaration Form Ohio

ADVERTISEMENT

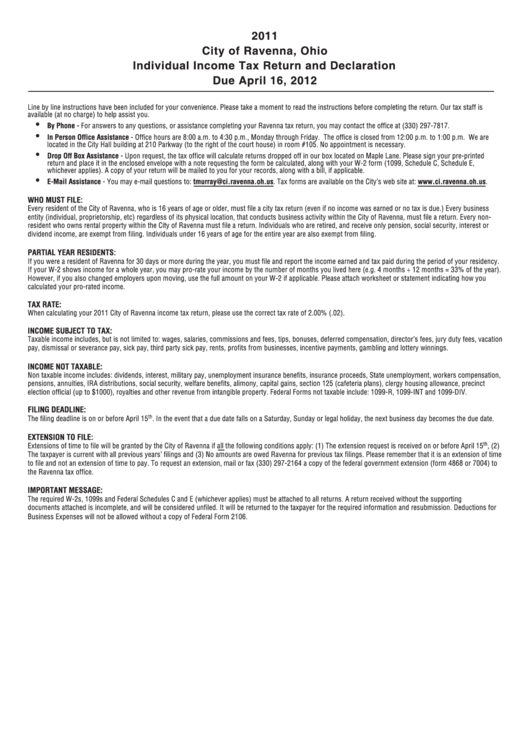

2011

City of Ravenna, Ohio

Individual Income Tax Return and Declaration

Due April 16, 2012

Line by line instructions have been included for your convenience. Please take a moment to read the instructions before completing the return. Our tax staff is

available (at no charge) to help assist you.

Ÿ

By Phone - For answers to any questions, or assistance completing your Ravenna tax return, you may contact the office at (330) 297-7817.

Ÿ

In Person Office Assistance - Office hours are 8:00 a.m. to 4:30 p.m., Monday through Friday. The office is closed from 12:00 p.m. to 1:00 p.m. We are

located in the City Hall building at 210 Parkway (to the right of the court house) in room #105. No appointment is necessary.

Ÿ

Drop Off Box Assistance - Upon request, the tax office will calculate returns dropped off in our box located on Maple Lane. Please sign your pre-printed

return and place it in the enclosed envelope with a note requesting the form be calculated, along with your W-2 form (1099, Schedule C, Schedule E,

whichever applies). A copy of your return will be mailed to you for your records, along with a bill, if applicable.

Ÿ

E-Mail Assistance - You may e-mail questions to: tmurray@ci.ravenna.oh.us. Tax forms are available on the City’s web site at:

WHO MUST FILE:

Every resident of the City of Ravenna, who is 16 years of age or older, must file a city tax return (even if no income was earned or no tax is due.) Every business

entity (individual, proprietorship, etc) regardless of its physical location, that conducts business activity within the City of Ravenna, must file a return. Every non-

resident who owns rental property within the City of Ravenna must file a return. Individuals who are retired, and receive only pension, social security, interest or

dividend income, are exempt from filing. Individuals under 16 years of age for the entire year are also exempt from filing.

PARTIAL YEAR RESIDENTS:

If you were a resident of Ravenna for 30 days or more during the year, you must file and report the income earned and tax paid during the period of your residency.

If your W-2 shows income for a whole year, you may pro-rate your income by the number of months you lived here (e.g. 4 months ÷ 12 months = 33% of the year).

However, if you also changed employers upon moving, use the full amount on your W-2 if applicable. Please attach worksheet or statement indicating how you

calculated your pro-rated income.

TAX RATE:

When calculating your 2011 City of Ravenna income tax return, please use the correct tax rate of 2.00% (.02).

INCOME SUBJECT TO TAX:

Taxable income includes, but is not limited to: wages, salaries, commissions and fees, tips, bonuses, deferred compensation, director’s fees, jury duty fees, vacation

pay, dismissal or severance pay, sick pay, third party sick pay, rents, profits from businesses, incentive payments, gambling and lottery winnings.

INCOME NOT TAXABLE:

Non taxable income includes: dividends, interest, military pay, unemployment insurance benefits, insurance proceeds, State unemployment, workers compensation,

pensions, annuities, IRA distributions, social security, welfare benefits, alimony, capital gains, section 125 (cafeteria plans), clergy housing allowance, precinct

election official (up to $1000), royalties and other revenue from intangible property. Federal Forms not taxable include: 1099-R, 1099-INT and 1099-DIV.

FILING DEADLINE:

th

The filing deadline is on or before April 15

. In the event that a due date falls on a Saturday, Sunday or legal holiday, the next business day becomes the due date.

EXTENSION TO FILE:

th

Extensions of time to file will be granted by the City of Ravenna if all the following conditions apply: (1) The extension request is received on or before April 15

, (2)

The taxpayer is current with all previous years’ filings and (3) No amounts are owed Ravenna for previous tax filings. Please remember that it is an extension of time

to file and not an extension of time to pay. To request an extension, mail or fax (330) 297-2164 a copy of the federal government extension (form 4868 or 7004) to

the Ravenna tax office.

IMPORTANT MESSAGE:

The required W-2s, 1099s and Federal Schedules C and E (whichever applies) must be attached to all returns. A return received without the supporting

documents attached is incomplete, and will be considered unfiled. It will be returned to the taxpayer for the required information and resubmission. Deductions for

Business Expenses will not be allowed without a copy of Federal Form 2106.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2