Schedule P - Part Year Resident Calculation

ADVERTISEMENT

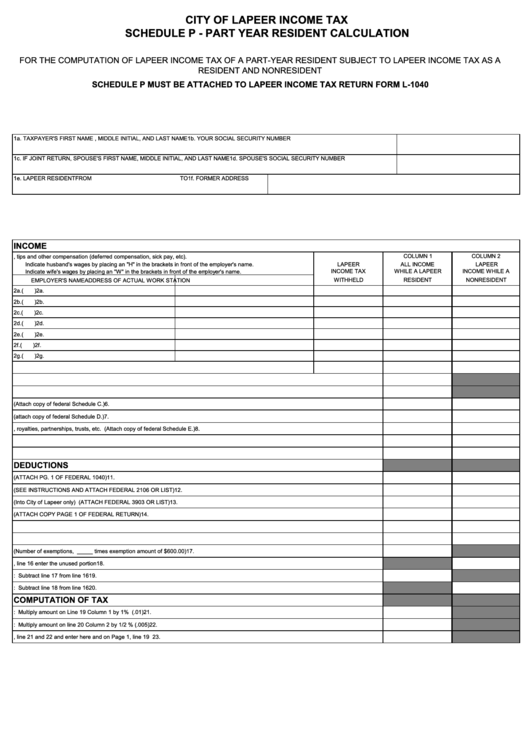

CITY OF LAPEER INCOME TAX

SCHEDULE P - PART YEAR RESIDENT CALCULATION

FOR THE COMPUTATION OF LAPEER INCOME TAX OF A PART-YEAR RESIDENT SUBJECT TO LAPEER INCOME TAX AS A

RESIDENT AND NONRESIDENT

SCHEDULE P MUST BE ATTACHED TO LAPEER INCOME TAX RETURN FORM L-1040

1a. TAXPAYER'S FIRST NAME , MIDDLE INITIAL, AND LAST NAME

1b. YOUR SOCIAL SECURITY NUMBER

1c. IF JOINT RETURN, SPOUSE'S FIRST NAME, MIDDLE INITIAL, AND LAST NAME

1d. SPOUSE'S SOCIAL SECURITY NUMBER

1e. LAPEER RESIDENT

FROM

TO

1f. FORMER ADDRESS

INCOME

2.

Wages, tips and other compensation (deferred compensation, sick pay, etc).

COLUMN 1

COLUMN 2

LAPEER

ALL INCOME

LAPEER

Indicate husband's wages by placing an "H" in the brackets in front of the employer's name.

INCOME TAX

WHILE A LAPEER

INCOME WHILE A

Indicate wife's wages by placing an "W" in the brackets in front of the employer's name.

WITHHELD

RESIDENT

NONRESIDENT

EMPLOYER'S NAME

ADDRESS OF ACTUAL WORK STATION

2a. (

)

2a.

2b. (

)

2b.

2c. (

)

2c.

2d. (

)

2d.

2e. (

)

2e.

2f. (

)

2f.

2g. (

)

2g.

3.

TOTAL COMPENSATION AND LAPEER TAX WITHHELD

3.

4.

Taxable interest

4.

5.

Ordinary dividends

5.

6.

Business Income. (Attach copy of federal Schedule C.)

6.

7.

Capital gains or losses. (attach copy of federal Schedule D.)

7.

8.

Rental real estate, royalties, partnerships, trusts, etc. (Attach copy of federal Schedule E.)

8.

9.

Other income. Attach statement listing type and amount.

9.

10.

TOTAL INCOME. ADD LINES 3 THROUGH 9

10.

DEDUCTIONS

11.

Individual Retirement Account. (ATTACH PG. 1 OF FEDERAL 1040)

11.

12.

Employee business expenses. (SEE INSTRUCTIONS AND ATTACH FEDERAL 2106 OR LIST)

12.

13.

Moving expenses. (Into City of Lapeer only) (ATTACH FEDERAL 3903 OR LIST)

13.

14.

Alimony paid. DO NOT INCLUDE CHILD SUPPORT (ATTACH COPY PAGE 1 OF FEDERAL RETURN)

14.

15.

TOTAL DEDUCTIONS. ADD LINES 11 THROUGH 14

15.

16.

TOTAL INCOME AFTER DEDUCTIONS. SUBTRACT LINE 15 FROM LINE 10

16.

17.

Amount for exemptions. (Number of exemptions, _____ times exemption amount of $600.00)

17.

18.

Excess exemption amount. If amount on line 17 exceeds the amount in column 1, line 16 enter the unused portion

18.

19.

Total income subject to tax as a resident. Column 1: Subtract line 17 from line 16

19.

20.

Total income subject to tax as a nonresident. Column 2: Subtract line 18 from line 16

20.

COMPUTATION OF TAX

21.

Tax while RESIDENT: Multiply amount on Line 19 Column 1 by 1% (.01)

21.

22.

Tax while NONRESIDENT: Multiply amount on line 20 Column 2 by 1/2 % (.005)

22.

23.

TOTAL TAX. Add Column 1, line 21 and 22 and enter here and on Page 1, line 19

23.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1