Form Rev-798 Ct - Schedule C-2 Pa Dividend Deduction

ADVERTISEMENT

REV-798 CT (07-10)

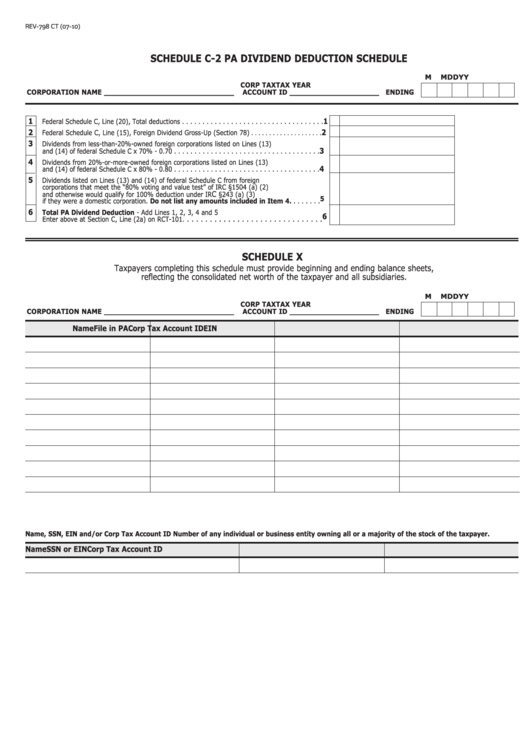

SCHEDULE C-2 PA DIVIDEND DEDUCTION SCHEDULE

M

M

D

D

Y

Y

CORP TAX

TAX YEAR

CORPORATION NAME ________________________________

ACCOUNT ID ______________________ ENDING

1

1

Federal Schedule C, Line (20), Total deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2

Federal Schedule C, Line (15), Foreign Dividend Gross-Up (Section 78)

. . . . . . . . . . . . . . . . . . . .

3

Dividends from less-than-20%-owned foreign corporations listed on Lines (13)

3

and (14) of federal Schedule C x 70% - 0.70 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Dividends from 20%-or-more-owned foreign corporations listed on Lines (13)

4

and (14) of federal Schedule C x 80% - 0.80 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Dividends listed on Lines (13) and (14) of federal Schedule C from foreign

corporations that meet the “80% voting and value test” of IRC §1504 (a) (2)

C

and otherwise would qualify for 100% deduction under IR

§243 (a) (3)

5

if they were a domestic corporation. Do not list any amounts included in Item 4. . . . . . . .

6

Total PA Dividend Deduction - Add Lines 1, 2, 3, 4 and 5

6

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter above at Section C, Line (2a) on RCT-101.

SCHEDULE X

Taxpayers completing this schedule must provide beginning and ending balance sheets,

reflecting the consolidated net worth of the taxpayer and all subsidiaries.

M

M

D

D

Y

Y

CORP TAX

TAX YEAR

CORPORATION NAME ________________________________

ACCOUNT ID ______________________ ENDING

Name

File in PA

Corp Tax Account ID

EIN

Name, SSN, EIN and/or Corp Tax Account ID Number of any individual or business entity owning all or a majority of the stock of the taxpayer.

Name

SSN or EIN

Corp Tax Account ID

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1