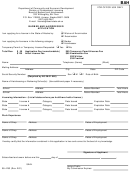

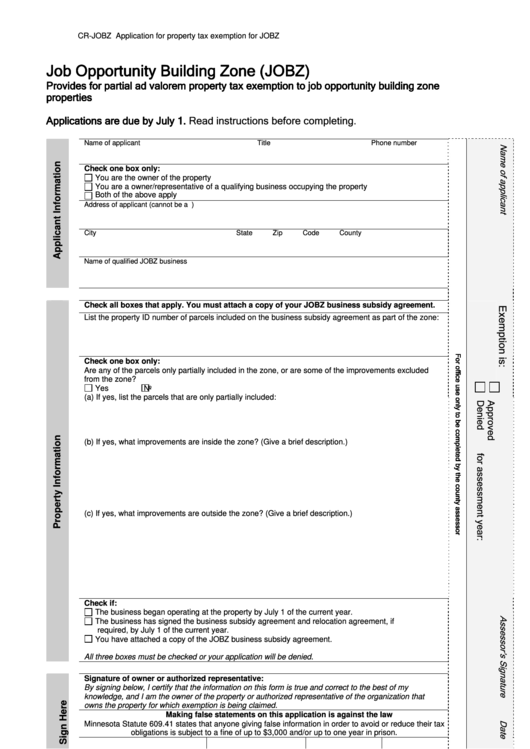

CR-JOBZ

Application for property tax exemption for JOBZ

Job Opportunity Building Zone (JOBZ)

Provides for partial ad valorem property tax exemption to job opportunity building zone

properties

Applications are due by July 1. Read instructions before completing.

Name of applicant

Title

Phone number

Check one box only:

You are the owner of the property

You are a owner/representative of a qualifying business occupying the property

Both of the above apply

Address of applicant (cannot be a P.O. Box number)

City

State

Zip Code

County

Name of qualified JOBZ business

Check all boxes that apply. You must attach a copy of your JOBZ business subsidy agreement.

List the property ID number of parcels included on the business subsidy agreement as part of the zone:

Check one box only:

Are any of the parcels only partially included in the zone, or are some of the improvements excluded

from the zone?

Yes

No

(a) If yes, list the parcels that are only partially included:

(b) If yes, what improvements are inside the zone? (Give a brief description.)

(c) If yes, what improvements are outside the zone? (Give a brief description.)

Check if:

The business began operating at the property by July 1 of the current year.

The business has signed the business subsidy agreement and relocation agreement, if

required, by July 1 of the current year.

You have attached a copy of the JOBZ business subsidy agreement.

All three boxes must be checked or your application will be denied.

Signature of owner or authorized representative:

By signing below, I certify that the information on this form is true and correct to the best of my

knowledge, and I am the owner of the property or authorized representative of the organization that

owns the property for which exemption is being claimed.

Making false statements on this application is against the law

Minnesota Statute 609.41 states that anyone giving false information in order to avoid or reduce their tax

obligations is subject to a fine of up to $3,000 and/or up to one year in prison.

Signature of applicant

Title

Date

Daytime phone

Please return completed application and required attachments to your county assessor.

Revised 03/08

1

1 2

2