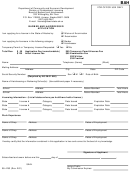

CR-JOBZ

Application for property tax exemption for JOBZ

Instructions for JOBZ form

Required attachments

The existing footprint would

Who is eligible

You must attach a signed

be listed and described under

You may qualify for a partial tax

and approved job

item (c) as an improvement

exemption for taxes payable in

opportunity building zone

outside the zone. The new

the following year on

(JOBZ) business subsidy

additions and improvements

improvements to property in a

agreement and relocation

on the property would be

(JOBZ) zone if:

agreement, if required, to

• The business occupied the

included under item (b) as

the application.

improvements inside the

property by July 1 of the

zone.

current year.

Note: You must clearly

• The business has a signed

denote the property to be

Penalties

business subsidy agreement

included in JOBZ

Making false statements on

and relocation agreement, if

exemption on the

this application is against

required, by July 1 of the

agreement. This may

the law. Minnesota Statute

current year.

include the entire

609.41 states that anyone

property or certain

giving false information in

How to apply

portions of it.

order to avoid or reduce their

Fill out all information

tax obligations is subject to a

completely and legibly.

If you have parcels that

fine of up to $3,000 and/or up

are only partially included

to one year in prison.

Either the owner of the property

in the zone:

List the property ID

or the owner/representative of a

numbers of the parcels

Information and

business occupying the property

that are only partially

can complete the application. Be

assistance

included in the zone

sure to check the appropriate

under item (a). Then, list

boxes concerning ownership of

If you need additional

and describe what

the property.

information or assistance,

improvements are inside

contact your county assessor.

or outside the zone under

Applications must be completed

items (b) and (c).

and turned in to the county

Resources are also available

assessor by July 1 to be effective

through the Department of

For example:

for taxes payable in the following

Employment and Economic

A JOBZ property does

year. There is no need to

Development

not include the existing

( )

annually apply, but you must

footprint of a structure,

or through the Department of

notify your county assessor

but does include the new

Revenue

immediately if you are no longer

additions and

(

).

eligible for exemption.

improvements on the

property.

Revised 03/08

1

1 2

2