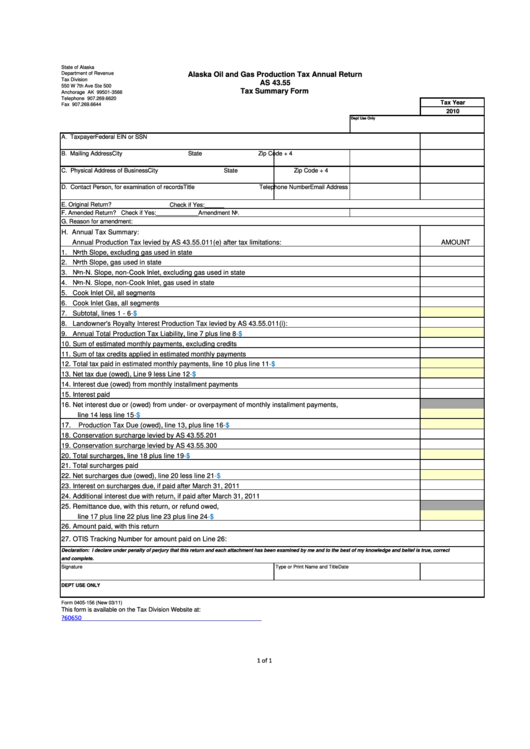

Form 0405-156 - Alaska Oil And Gas Production Tax Annual Return - Tax Summary Form - 2010

ADVERTISEMENT

State of Alaska

Department of Revenue

Alaska Oil and Gas Production Tax Annual Return

Tax Division

AS 43.55

550 W 7th Ave Ste 500

Tax Summary Form

Anchorage AK 99501-3566

Telephone 907.269.6620

Tax Year

Fax 907.269.6644

2010

Dept Use Only

A. Taxpayer

Federal EIN or SSN

B. Mailing Address

City

State

Zip Code + 4

C. Physical Address of Business

City

State

Zip Code + 4

D. Contact Person, for examination of records

Title

Telephone Number

Email Address

Check if Yes:______

E. Original Return?

F. Amended Return?

Check if Yes:_____________

Amendment No.

G. Reason for amendment:

H. Annual Tax Summary:

Annual Production Tax levied by AS 43.55.011(e) after tax limitations:

AMOUNT

1. North Slope, excluding gas used in state

2. North Slope, gas used in state

3. Non-N. Slope, non-Cook Inlet, excluding gas used in state

4. Non-N. Slope, non-Cook Inlet, gas used in state

5. Cook Inlet Oil, all segments

6. Cook Inlet Gas, all segments

7. Subtotal, lines 1 - 6

$

-

8. Landowner's Royalty Interest Production Tax levied by AS 43.55.011(i):

9. Annual Total Production Tax Liability, line 7 plus line 8

$

-

10. Sum of estimated monthly payments, excluding credits

11. Sum of tax credits applied in estimated monthly payments

12. Total tax paid in estimated monthly payments, line 10 plus line 11

$

-

13. Net tax due (owed), Line 9 less Line 12

$

-

14. Interest due (owed) from monthly installment payments

15. Interest paid

16. Net interest due or (owed) from under- or overpayment of monthly installment payments,

line 14 less line 15

$

-

17.

Production Tax Due (owed), line 13, plus line 16

$

-

18. Conservation surcharge levied by AS 43.55.201

19. Conservation surcharge levied by AS 43.55.300

20. Total surcharges, line 18 plus line 19

$

-

21. Total surcharges paid

22. Net surcharges due (owed), line 20 less line 21

$

-

23. Interest on surcharges due, if paid after March 31, 2011

24. Additional interest due with return, if paid after March 31, 2011

25. Remittance due, with this return, or refund owed,

line 17 plus line 22 plus line 23 plus line 24

$

-

26. Amount paid, with this return

27. OTIS Tracking Number for amount paid on Line 26:

Declaration: I declare under penalty of perjury that this return and each attachment has been examined by me and to the best of my knowledge and belief is true, correct

and complete.

Signature

Type or Print Name and Title

Date

DEPT USE ONLY

Form 0405-156 (New 03/11)

This form is available on the Tax Division Website at:

1 of 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1