Instructions For Alaska Notice Of Transfer Of Alaska Oil And Gas Production Tax Credit Certificates Under As 43.55.023 And 43.55.025

ADVERTISEMENT

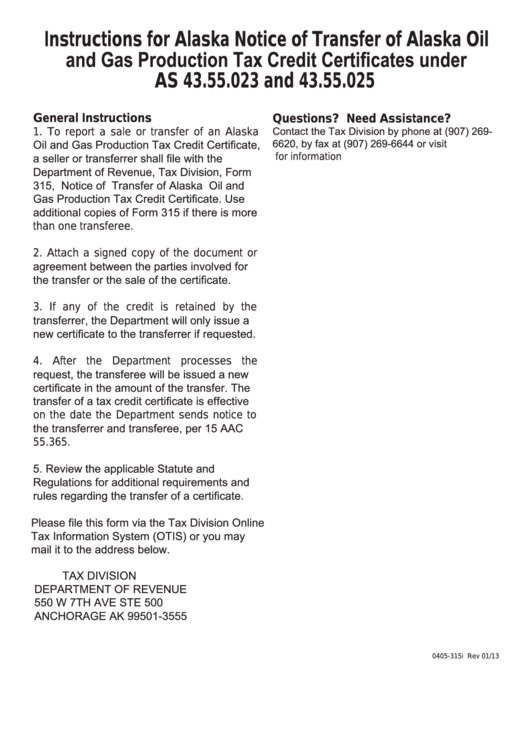

Instructions for Alaska Notice of Transfer of Alaska Oil

and Gas Production Tax Credit Certificates under

AS 43.55.023 and 43.55.025

General Instructions

Questions? Need Assistance?

1. To report a sale or transfer of an Alaska

Contact the Tax Division by phone at (907) 269-

6620, by fax at (907) 269-6644 or visit

Oil and Gas Production Tax Credit Certificate,

alaska.gov for information

a seller or transferrer shall file with the

Department of Revenue, Tax Division, Form

315, Notice of Transfer of Alaska Oil and

Gas Production Tax Credit Certificate. Use

additional copies of Form 315 if there is more

than one transferee.

2. Attach a signed copy of the document or

agreement between the parties involved for

the transfer or the sale of the certificate.

3. If any of the credit is retained by the

transferrer, the Department will only issue a

new certificate to the transferrer if requested.

4. After the Department processes the

request, the transferee will be issued a new

certificate in the amount of the transfer. The

transfer of a tax credit certificate is effective

on the date the Department sends notice to

the transferrer and transferee, per 15 AAC

55.365.

5. Review the applicable Statute and

Regulations for additional requirements and

rules regarding the transfer of a certificate.

Please file this form via the Tax Division Online

Tax Information System (OTIS) or you may

mail it to the address below.

TAX DIVISION

DEPARTMENT OF REVENUE

550 W 7TH AVE STE 500

ANCHORAGE AK 99501-3555

0405-315i Rev 01/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1