Instructions For Filing The 2016 Form 802 The Virginia Surplus Lines Broker'S Annual Reconciliation Tax Report

ADVERTISEMENT

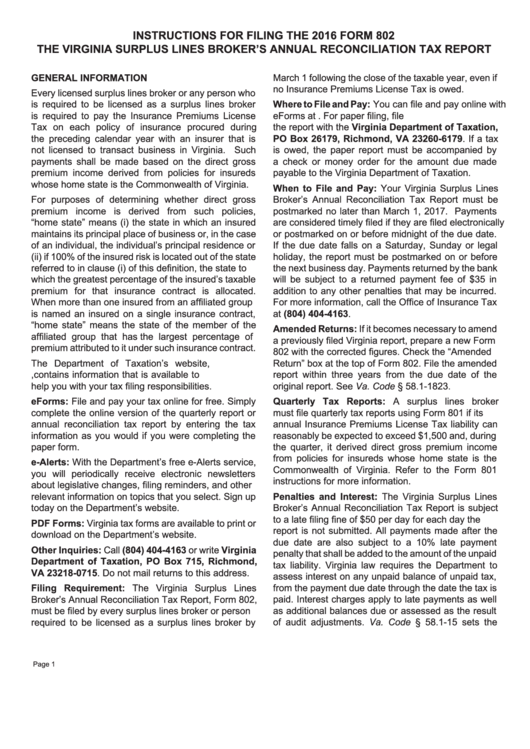

INSTRUCTIONS FOR FILING THE 2016 FORM 802

THE VIRGINIA SURPLUS LINES BROKER’S ANNUAL RECONCILIATION TAX REPORT

GENERAL INFORMATION

March 1 following the close of the taxable year, even if

no Insurance Premiums License Tax is owed.

Every licensed surplus lines broker or any person who

is required to be licensed as a surplus lines broker

Where to File and Pay: You can file and pay online with

is required to pay the Insurance Premiums License

eForms at For paper filing, file

the report with the Virginia Department of Taxation,

Tax on each policy of insurance procured during

the preceding calendar year with an insurer that is

PO Box 26179, Richmond, VA 23260-6179. If a tax

not licensed to transact business in Virginia. Such

is owed, the paper report must be accompanied by

payments shall be made based on the direct gross

a check or money order for the amount due made

premium income derived from policies for insureds

payable to the Virginia Department of Taxation.

whose home state is the Commonwealth of Virginia.

When to File and Pay: Your Virginia Surplus Lines

For purposes of determining whether direct gross

Broker’s Annual Reconciliation Tax Report must be

premium income is derived from such policies,

postmarked no later than March 1, 2017. Payments

“home state” means (i) the state in which an insured

are considered timely filed if they are filed electronically

maintains its principal place of business or, in the case

or postmarked on or before midnight of the due date.

of an individual, the individual’s principal residence or

If the due date falls on a Saturday, Sunday or legal

(ii) if 100% of the insured risk is located out of the state

holiday, the report must be postmarked on or before

referred to in clause (i) of this definition, the state to

the next business day. Payments returned by the bank

which the greatest percentage of the insured’s taxable

will be subject to a returned payment fee of $35 in

premium for that insurance contract is allocated.

addition to any other penalties that may be incurred.

When more than one insured from an affiliated group

For more information, call the Office of Insurance Tax

is named an insured on a single insurance contract,

at (804) 404-4163.

“home state” means the state of the member of the

Amended Returns: If it becomes necessary to amend

affiliated group that has the largest percentage of

a previously filed Virginia report, prepare a new Form

premium attributed to it under such insurance contract.

802 with the corrected figures. Check the “Amended

The Department of Taxation’s website,

Return” box at the top of Form 802. File the amended

virginia.gov, contains information that is available to

report within three years from the due date of the

help you with your tax filing responsibilities.

original report. See Va. Code § 58.1-1823.

eForms: File and pay your tax online for free. Simply

Quarterly Tax Reports: A surplus lines broker

complete the online version of the quarterly report or

must file quarterly tax reports using Form 801 if its

annual reconciliation tax report by entering the tax

annual Insurance Premiums License Tax liability can

information as you would if you were completing the

reasonably be expected to exceed $1,500 and, during

paper form.

the quarter, it derived direct gross premium income

from policies for insureds whose home state is the

e-Alerts: With the Department’s free e-Alerts service,

Commonwealth of Virginia. Refer to the Form 801

you will periodically receive electronic newsletters

instructions for more information.

about legislative changes, filing reminders, and other

relevant information on topics that you select. Sign up

Penalties and Interest: The Virginia Surplus Lines

today on the Department’s website.

Broker’s Annual Reconciliation Tax Report is subject

to a late filing fine of $50 per day for each day the

PDF Forms: Virginia tax forms are available to print or

report is not submitted. All payments made after the

download on the Department’s website.

due date are also subject to a 10% late payment

Other Inquiries: Call (804) 404-4163 or write Virginia

penalty that shall be added to the amount of the unpaid

Department of Taxation, PO Box 715, Richmond,

tax liability. Virginia law requires the Department to

VA 23218-0715. Do not mail returns to this address.

assess interest on any unpaid balance of unpaid tax,

from the payment due date through the date the tax is

Filing Requirement: The Virginia Surplus Lines

paid. Interest charges apply to late payments as well

Broker’s Annual Reconciliation Tax Report, Form 802,

must be filed by every surplus lines broker or person

as additional balances due or assessed as the result

required to be licensed as a surplus lines broker by

of audit adjustments. Va. Code § 58.1-15 sets the

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3