Small Claims Determination Form - New York Division Of Tax Appeals

ADVERTISEMENT

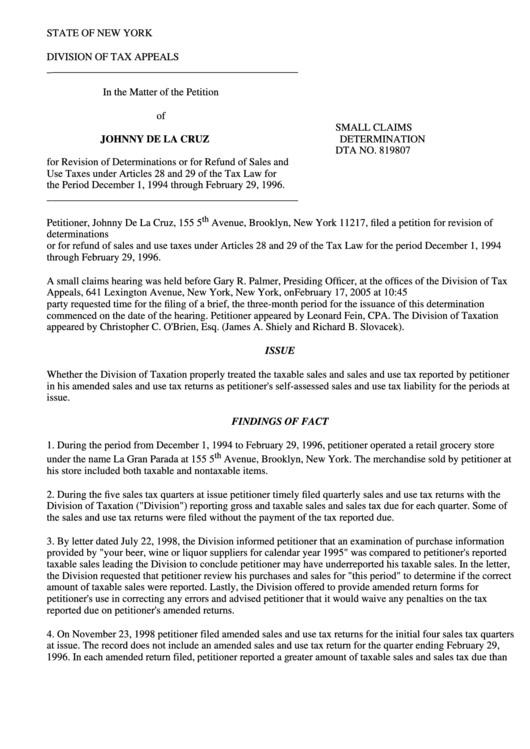

STATE OF NEW YORK

DIVISION OF TAX APPEALS

________________________________________________

In the Matter of the Petition

of

SMALL CLAIMS

JOHNNY DE LA CRUZ

DETERMINATION

DTA NO. 819807

for Revision of Determinations or for Refund of Sales and

Use Taxes under Articles 28 and 29 of the Tax Law for

the Period December 1, 1994 through February 29, 1996.

________________________________________________

th

Petitioner, Johnny De La Cruz, 155 5

Avenue, Brooklyn, New York 11217, filed a petition for revision of

determinations

or for refund of sales and use taxes under Articles 28 and 29 of the Tax Law for the period December 1, 1994

through February 29, 1996.

A small claims hearing was held before Gary R. Palmer, Presiding Officer, at the offices of the Division of Tax

Appeals, 641 Lexington Avenue, New York, New York, on February 17, 2005 at 10:45 P.M. Because neither

party requested time for the filing of a brief, the three-month period for the issuance of this determination

commenced on the date of the hearing. Petitioner appeared by Leonard Fein, CPA. The Division of Taxation

appeared by Christopher C. O'Brien, Esq. (James A. Shiely and Richard B. Slovacek).

ISSUE

Whether the Division of Taxation properly treated the taxable sales and sales and use tax reported by petitioner

in his amended sales and use tax returns as petitioner's self-assessed sales and use tax liability for the periods at

issue.

FINDINGS OF FACT

1. During the period from December 1, 1994 to February 29, 1996, petitioner operated a retail grocery store

th

under the name La Gran Parada at 155 5

Avenue, Brooklyn, New York. The merchandise sold by petitioner at

his store included both taxable and nontaxable items.

2. During the five sales tax quarters at issue petitioner timely filed quarterly sales and use tax returns with the

Division of Taxation ("Division") reporting gross and taxable sales and sales tax due for each quarter. Some of

the sales and use tax returns were filed without the payment of the tax reported due.

3. By letter dated July 22, 1998, the Division informed petitioner that an examination of purchase information

provided by "your beer, wine or liquor suppliers for calendar year 1995" was compared to petitioner's reported

taxable sales leading the Division to conclude petitioner may have underreported his taxable sales. In the letter,

the Division requested that petitioner review his purchases and sales for "this period" to determine if the correct

amount of taxable sales were reported. Lastly, the Division offered to provide amended return forms for

petitioner's use in correcting any errors and advised petitioner that it would waive any penalties on the tax

reported due on petitioner's amended returns.

4. On November 23, 1998 petitioner filed amended sales and use tax returns for the initial four sales tax quarters

at issue. The record does not include an amended sales and use tax return for the quarter ending February 29,

1996. In each amended return filed, petitioner reported a greater amount of taxable sales and sales tax due than

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3