Determination Form - New York Division Of Tax Appeals

ADVERTISEMENT

STATE OF NEW YORK

DIVISION OF TAX APPEALS

________________________________________________

In the Matter of the Petition

of

JOSEPH JAMIN

DETERMINATION

for Redetermination of a Deficiency or Refund of

DTA NO. 819820

Personal Income Tax under Article 22 of the Tax Law for

the Period October 1, 2000 through September 30, 2001.

________________________________________________

Petitioner, Joseph Jamin, 40 Beale Road, Cold Spring, New York 10516, filed a petition for redetermination of

a deficiency

or for refund of personal income tax under Article 22 of the Tax Law for the period October 1, 2000 through

September 30, 2001.

A hearing was held before Joseph W. Pinto, Jr., Administrative Law Judge, at the offices of the Division of Tax

Appeals,

500 Federal Street, Troy, New York, on December 16, 2004 at 12:00 P.M., with all briefs to be submitted by

April 25, 2005, which date began the six-month period for the issuance of this determination. Petitioner

appeared by Robert L. Markovits, Esq. The Division of Taxation appeared by Christopher C. O'Brien, Esq.

( Kevin R. Law, Esq., of counsel).

ISSUE

Whether petitioner was a person required to collect, truthfully account for and pay over withholding tax on

behalf of Geophysical Environmental Research Corp., who willfully failed to do so, thus becoming liable for a

penalty equal to the

unpaid tax pursuant to Tax Law § 685(g).

FINDINGS OF FACT

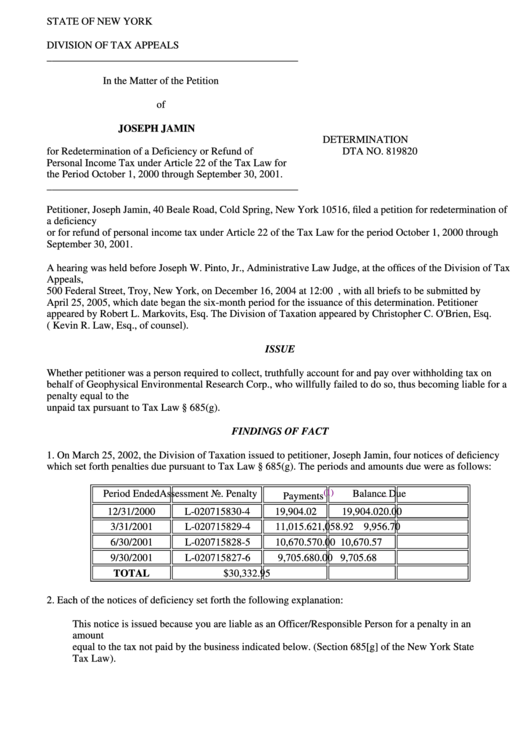

1. On March 25, 2002, the Division of Taxation issued to petitioner, Joseph Jamin, four notices of deficiency

which set forth penalties due pursuant to Tax Law § 685(g). The periods and amounts due were as follows:

(1)

Period Ended

Assessment No.

Penalty

Balance Due

Payments

12/31/2000

L-020715830-4

19,904.02

19,904.02

0.00

3/31/2001

L-020715829-4

11,015.62

1,058.92

9,956.70

6/30/2001

L-020715828-5

10,670.57

0.00

10,670.57

9/30/2001

L-020715827-6

9,705.68

0.00

9,705.68

TOTAL

$30,332.95

2. Each of the notices of deficiency set forth the following explanation:

This notice is issued because you are liable as an Officer/Responsible Person for a penalty in an

amount

equal to the tax not paid by the business indicated below. (Section 685[g] of the New York State

Tax Law).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5