Form Pda-51 - Undyed Diesel Fuel In Distributor Storage Tax Return - Minnesota Department Of Revenue

ADVERTISEMENT

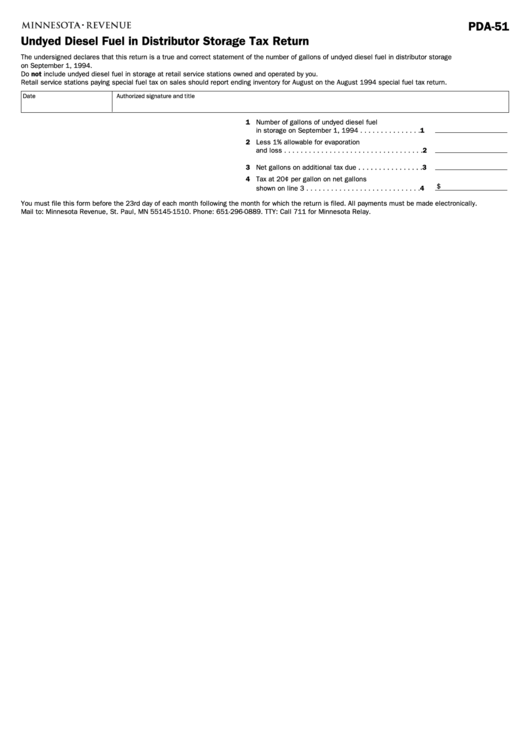

PDA-51

Undyed Diesel Fuel in Distributor Storage Tax Return

The undersigned declares that this return is a true and correct statement of the number of gallons of undyed diesel fuel in distributor storage

on September 1, 1994.

Do not include undyed diesel fuel in storage at retail service stations owned and operated by you.

Retail service stations paying special fuel tax on sales should report ending inventory for August on the August 1994 special fuel tax return.

Date

Authorized signature and title

1 Number of gallons of undyed diesel fuel

in storage on September 1, 1994 . . . . . . . . . . . . . . . 1

2 Less 1% allowable for evaporation

and loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Net gallons on additional tax due . . . . . . . . . . . . . . . . 3

4 Tax at 20¢ per gallon on net gallons

$

shown on line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

You must file this form before the 23rd day of each month following the month for which the return is filed. All payments must be made electronically.

Mail to: Minnesota Revenue, St. Paul, MN 55145-1510. Phone: 651-296-0889. TTY: Call 711 for Minnesota Relay.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1