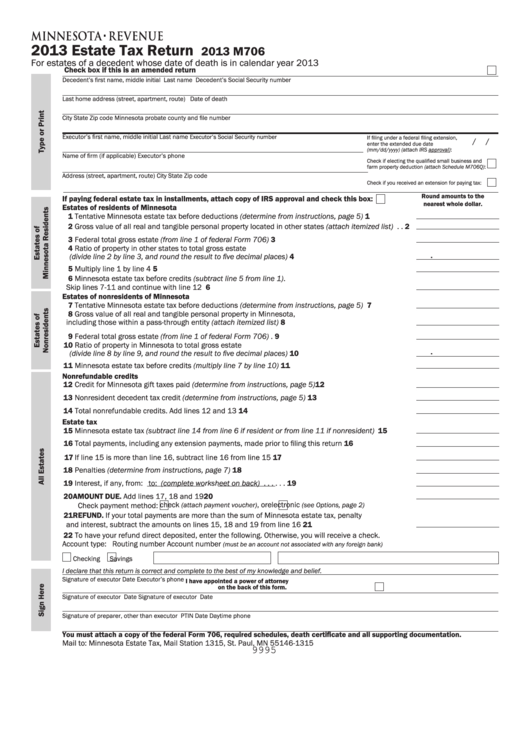

2013 Estate Tax Return

2013 M706

For estates of a decedent whose date of death is in calendar year 2013

Check box if this is an amended return

Decedent’s first name, middle initial

Last name

Decedent’s Social Security number

Last home address (street, apartment, route)

Date of death

City

State

Zip code

Minnesota probate county and file number

Executor’s first name, middle initial

Last name

Executor’s Social Security number

If filing under a federal filing extension,

/

/

enter the extended due date

(mm/dd/yyyy) (attach IRS approval):

Name of firm (if applicable)

Executor’s phone

Check if electing the qualified small business and

farm property deduction (attach Schedule M706Q):

Address (street, apartment, route)

City

State

Zip code

Check if you received an extension for paying tax:

Round amounts to the

If paying federal estate tax in installments, attach copy of IRS approval and check this box:

nearest whole dollar.

Estates of residents of Minnesota

1 Tentative Minnesota estate tax before deductions (determine from instructions, page 5) . . . . . . . . . . 1

2 Gross value of all real and tangible personal property located in other states (attach itemized list) . . 2

3 Federal total gross estate (from line 1 of federal Form 706) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Ratio of property in other states to total gross estate

.

(divide line 2 by line 3, and round the result to five decimal places) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Multiply line 1 by line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Minnesota estate tax before credits (subtract line 5 from line 1) .

Skip lines 7-11 and continue with line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Estates of nonresidents of Minnesota

7 Tentative Minnesota estate tax before deductions (determine from instructions, page 5) . . . . . . . . . . 7

8 Gross value of all real and tangible personal property in Minnesota,

including those within a pass-through entity (attach itemized list) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Federal total gross estate (from line 1 of federal Form 706) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Ratio of property in Minnesota to total gross estate

.

(divide line 8 by line 9, and round the result to five decimal places) . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Minnesota estate tax before credits (multiply line 7 by line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Nonrefundable credits

12 Credit for Minnesota gift taxes paid (determine from instructions, page 5) . . . . . . . . . . . . . . . . . . . . . . 12

13 Nonresident decedent tax credit (determine from instructions, page 5) . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Total nonrefundable credits. Add lines 12 and 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Estate tax

15 Minnesota estate tax (subtract line 14 from line 6 if resident or from line 11 if nonresident) . . . . . . 15

16 Total payments, including any extension payments, made prior to filing this return . . . . . . . . . . . . . . . 16

17 If line 15 is more than line 16, subtract line 16 from line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Penalties (determine from instructions, page 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Interest, if any, from:

to:

(complete worksheet on back) . . . . . . 19

20 AMOUNT DUE. Add lines 17, 18 and 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

check

, or

electronic

(attach payment voucher)

(see Options, page 2)

Check payment method:

21 REFUND. If your total payments are more than the sum of Minnesota estate tax, penalty

and interest, subtract the amounts on lines 15, 18 and 19 from line 16 . . . . . . . . . . . . . . . . . . . . . . . 21

22 To have your refund direct deposited, enter the following. Otherwise, you will receive a check.

Account type:

Routing number

Account number

(must be an account not associated with any foreign bank)

Checking

Savings

I declare that this return is correct and complete to the best of my knowledge and belief.

Signature of executor

Date

Executor’s phone

I have appointed a power of attorney

on the back of this form.

Signature of executor

Date

Signature of executor

Date

Signature of preparer, other than executor

PTIN

Date

Daytime phone

You must attach a copy of the federal Form 706, required schedules, death certificate and all supporting documentation.

Mail to: Minnesota Estate Tax, Mail Station 1315, St. Paul, MN 55146-1315

9995

1

1 2

2