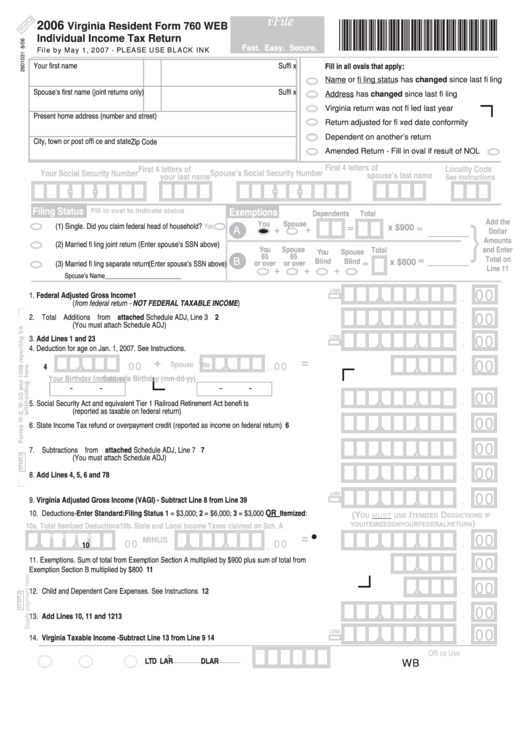

Virginia Resident Form 760 Web - Individual Income Tax Return - 2006

ADVERTISEMENT

iFile

2006

Virginia Resident Form 760 WEB

Individual Income Tax Return

File by May 1, 2007 - PLEASE USE BLACK INK

Fast. Easy. Secure.

Your fi rst name

M.I.

Last name

Suffi x

Fill in all ovals that apply:

Name or fi ling status has changed since last fi ling

Spouse’s fi rst name (joint returns only) M.I.

Last name

Suffi x

Address has changed since last fi ling

Virginia return was not fi led last year

Present home address (number and street)

Return adjusted for fi xed date conformity

Dependent on another’s return

City, town or post offi ce and state

Zip Code

Amended Return - Fill in oval if result of NOL

First 4 letters of

First 4 letters of

Locality Code

Your Social Security Number

Spouse’s Social Security Number

spouse’s last name

your last name

See instructions

-

-

-

-

Filing Status

Exemptions

Fill in oval to indicate status

Dependents

Total

}

Add the

You

Spouse

(1) Single.

Did you claim federal head of household?

Yes

A

=

x $900

=

+

+

Dollar

Amounts

(2) Married fi ling joint return (Enter spouse’s SSN above)

You

Spouse

Total

and Enter

You

Spouse

65

65

B

Total on

=

Blind

Blind

(3) Married fi ling separate return (Enter spouse’s SSN above)

or over

or over

=

x $800

Line 11

+

+

+

Spouse’s Name________________________

LOSS

,

,

00

.

1. Federal Adjusted Gross Income .................................................................................................1

(from federal return - NOT FEDERAL TAXABLE INCOME)

2. Total Additions from attached Schedule ADJ, Line 3 ...................................................................2

,

,

.

00

(You must attach Schedule ADJ)

LOSS

3. Add Lines 1 and 2 ........................................................................................................................3

,

,

.

00

4. Deduction for age on Jan. 1, 2007. See Instructions.

,

+

,

=

.

00

.

00

,

.

You

Spouse

00

4

Your Birthday (mm-dd-yy)

Spouse’s Birthday (mm-dd-yy)

-

-

-

-

,

,

00

.

5. Social Security Act and equivalent Tier 1 Railroad Retirement Act benefi ts ................................ 5

(reported as taxable on federal return)

,

,

.

00

6. State Income Tax refund or overpayment credit (reported as income on federal return) ...............6

,

,

.

00

7. Subtractions from attached Schedule ADJ, Line 7 .......................................................................7

(You must attach Schedule ADJ)

,

,

.

00

8. Add Lines 4, 5, 6 and 7 ................................................................................................................8

LOSS

,

,

.

00

9. Virginia Adjusted Gross Income (VAGI) - Subtract Line 8 from Line 3 ....................................9

OR

10. Deductions-Enter Standard: Filing Status 1 = $3,000; 2 = $6,000; 3 = $3,000

Itemized:

OU MUST USE

(Y

I

D

TEMIZED

EDUCTIONS IF

)

10a. Total Itemized Deductions

10b. State and Local Income Taxes claimed on Sch. A

YOU ITEMIZED ON YOUR FEDERAL RETURN

mmmmmmmmm

=

v

00

,

,

,

,

,

,

.

00

00

MINUS

.

.

10

11. Exemptions. Sum of total from Exemption Section A multiplied by $900 plus sum of total from

,

00

.

Exemption Section B multiplied by $800 ...................................................................................... 11

,

.

00

12. Child and Dependent Care Expenses. See Instructions ..............................................................12

,

,

.

00

13. Add Lines 10, 11 and 12 ............................................................................................................13

,

,

LOSS

00

.

14. Virginia Taxable Income - Subtract Line 13 from Line 9 ........................................................14

Offi ce Use

____________

$

WB

LAR

DLAR

LTD

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2