Initial Use Tax Form

ADVERTISEMENT

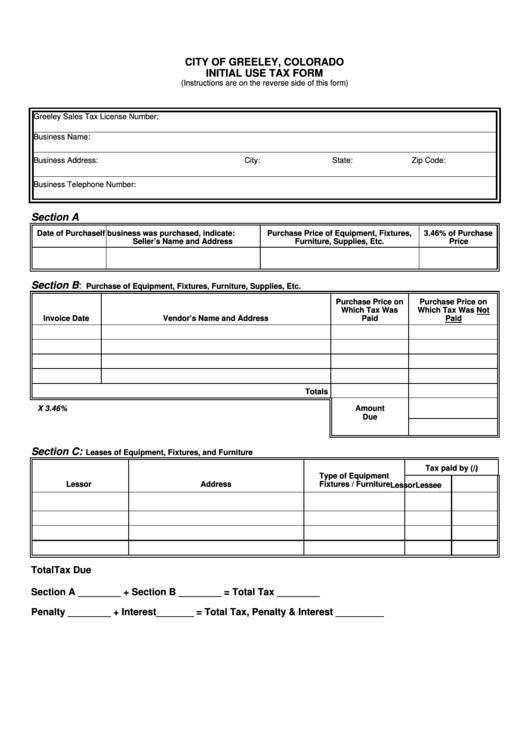

CITY OF GREELEY, COLORADO

INITIAL USE TAX FORM

(Instructions are on the reverse side of this form)

Greeley Sales Tax License Number:

Business Name:

Business Address:

City:

State:

Zip Code:

Business Telephone Number:

Section A

Date of Purchase

If business was purchased, indicate:

Purchase Price of Equipment, Fixtures,

3.46% of Purchase

Seller’s Name and Address

Furniture, Supplies, Etc.

Price

Section B

:

Purchase of Equipment, Fixtures, Furniture, Supplies, Etc.

Purchase Price on

Purchase Price on

Which Tax Was

Which Tax Was Not

Invoice Date

Vendor’s Name and Address

Paid

Paid

Totals

Amount

X 3.46%

Due

Section C:

Leases of Equipment, Fixtures, and Furniture

Tax paid by (/ / / / )

Type of Equipment

Lessor

Address

Fixtures / Furniture

Lessor

Lessee

Total Tax Due

Section A ________ + Section B ________ = Total Tax ________

Penalty ________ + Interest_______ = Total Tax, Penalty & Interest _________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2