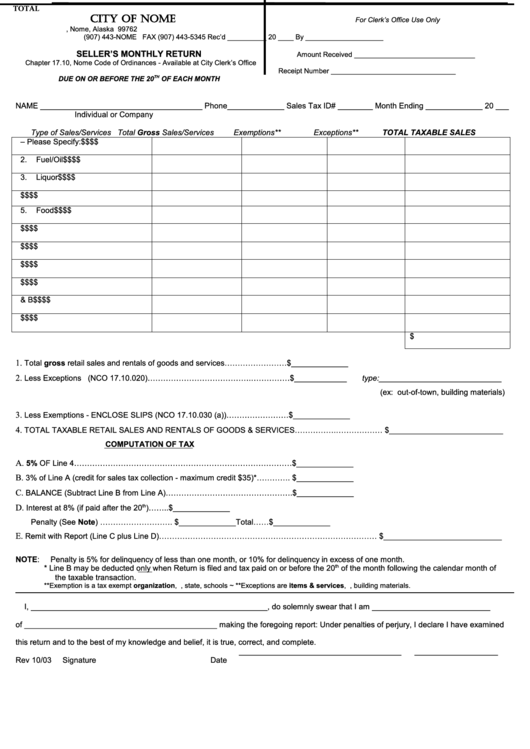

Seller'S Monthly Return Form - City Of Nome

ADVERTISEMENT

TOTAL

City of Nome

For Clerk’s Office Use Only

P.O. Box 281, Nome, Alaska 99762

(907) 443-NOME FAX (907) 443-5345

Rec’d __________ 20 ____ By ____________________

SELLER’S MONTHLY RETURN

Amount Received _______________________________

Chapter 17.10, Nome Code of Ordinances - Available at City Clerk’s Office

Receipt Number ________________________________

DUE ON OR BEFORE THE 20

TH

OF EACH MONTH

NAME _____________________________________ Phone_____________ Sales Tax ID# ________ Month Ending _____________ 20 ___

Individual or Company

Type of Sales/Services

Total Gross Sales/Services

Exemptions**

Exceptions**

TOTAL TAXABLE SALES

1.

Services – Please Specify:

$

$

$

$

2.

Fuel/Oil

$

$

$

$

3.

Liquor

$

$

$

$

4.

Recreational Vehicles/Boats

$

$

$

$

5.

Food

$

$

$

$

6.

Soft Goods/Sporting Goods

$

$

$

$

7.

Pull Tabs/Bingo

$

$

$

$

8.

Construction/Building Materials

$

$

$

$

9.

Restaurant

$

$

$

$

10. Hotel/Motel/B & B

$

$

$

$

11. Gift Shop

$

$

$

$

$

1.

Total gross retail sales and rentals of goods and services……………………$_____________

2.

Less Exceptions (NCO 17.10.020)………………………………….……………$____________

type:____________________________

(ex: out-of-town, building materials)

3.

Less Exemptions - ENCLOSE SLIPS (NCO 17.10.030 (a))……………………$_____________

4.

TOTAL TAXABLE RETAIL SALES AND RENTALS OF GOODS & SERVICES…………….……………… $__________________________

COMPUTATION OF TAX

A.

5% OF Line 4…………………………………………………………………………$_____________

B.

3% of Line A (credit for sales tax collection - maximum credit $35)*…………. $_____________

C.

BALANCE (Subtract Line B from Line A)………………………………………….$_____________

D.

Interest at 8% (if paid after the 20

th

)……..$_____________

Penalty (See Note) ………………………. $_____________

Total……$_____________

E.

Remit with Report (Line C plus Line D)…………………………………………………………………………

$___________________________

NOTE:

Penalty is 5% for delinquency of less than one month, or 10% for delinquency in excess of one month.

* Line B may be deducted only when Return is filed and tax paid on or before the 20

th

of the month following the calendar month of

the taxable transaction.

**Exemption is a tax exempt organization, i.e. city, state, schools ~ **Exceptions are items & services, i.e. out-of-town sales, building materials.

I, ______________________________________________________, do solemnly swear that I am ___________________________

of ____________________________________________ making the foregoing report: Under penalties of perjury, I declare I have examined

this return and to the best of my knowledge and belief, it is true, correct, and complete.

_____________________________________

___________________

Rev 10/03

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1