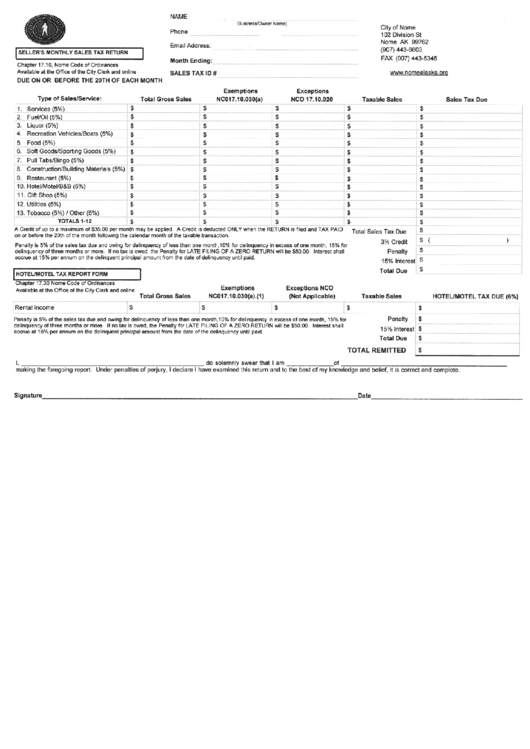

Sellers Monthly Sales Tax Return Form - City Of Nome

ADVERTISEMENT

NAME

(Business/Owner Name)

1.

Services (5%)

2.

Fuel/Oil (5%)

9.

Restaurant (5%)

10. Hotel/Motel/B&B (5%)

11. Gift Shop (5%)

12. Utilities (5%)

13. Tobacco (5%)! Other (5%)

TOTALS 1-12

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

3% Credit

$

Penalty

$

15% Interest

$

Total Due

$

$

Penalty

$

15% Interest

$

Total

Due

$

SELLERS MONTHLY SALES TAX RETURN

Chapter 17.10, Nome Code of Ordinances

Available at the Office of the City Clerk and online

DUE ON OR BEFORE THE 20TH OF EACH MONTH

Phone

Email Address:

Month Ending:

SALES TAX ID #

Type of SaleslService:

City of Nome

102 Division St

Total Gross Sales

Nome AK 99762

(907) 443-6603

FAX (907) 443-5345

Exemptions

NCOI 7.10.030(a)

3. Liquor (5%)

4.

Recreation Vehicles/Boats (5%)

5.

Food (5%)

6.

Soft Goods/Sporting Goods (5%)

$

7.

Pull Tabs/Bingo (5%)

$

8.

Construction/Building Materials (5%)

$

Exceptions

NCO 17.10.020

Taxable Sales

$

$

$

$

$

$

$

$

A Credit of up to a maximum of $35.00 per month may be applied. A Credit is deducted ONLY when the RETURN is filed and TAX PAID

on or before the 20th of the month following the calendar month of the taxable transaction.

Penalty is 5% of the sales tax due and owing for delinquency of less than one month,10% for delinquency in excess of one month, 15%

for

delinquency of three months or more. If no tax is owed, the Penalty for LATE FILING OF A ZERO RETURN will be $50.00. Interest shall

accrue at 15% per annum on the delinquent principal amount from the date of delinquency until paid.

HOTEUMOTEL

TAX

REPORT FORM

(.Thapter 17.30

Nome Gode of (Jrctinances

Available at the Office of the City Clerk and online

Total Sales Tax Due

Total Gross Sales

Sales Tax Due

HOTEL/MOTEL TAX DUE (6%)

Exemptions

NCOI 7.1 0.030(a).(1)

Rental Income

$

$

$

Penalty is 5% of the sales tax due and owing for delinquency of less than one month, 10% for delinquency in excess of one month, 15% for

delinquency of three months or more. If no tax is owed, the Penalty for LATE FILING OF A ZERO RETURN will be $50.00. Interest shall

accrue at 15% per annum on the delinquent principal amount from the date of the delinquency until paid.

Exceptions NCO

(Not Applicable)

$

Taxable Sales

I,

do solemnly swear that I am

making the foregoing report. Under penalties of perjury, I declare I have examined this return and to the best of my knowledge and belief, it is correct and complete.

TOTAL REMITTED

$

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1