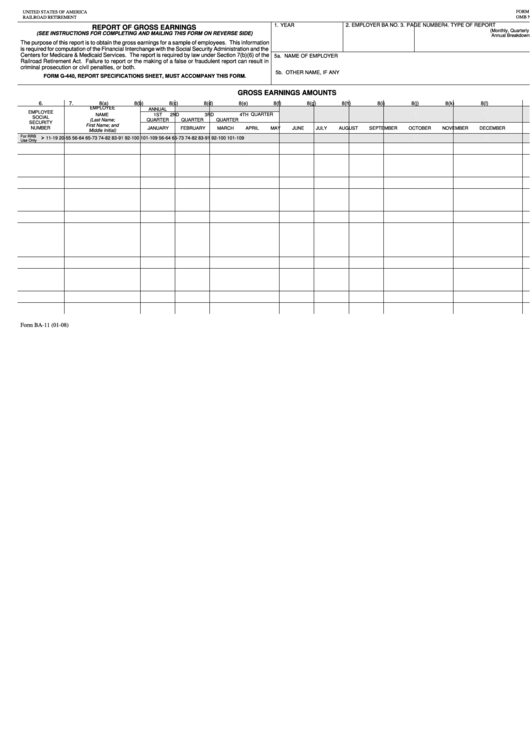

Form Ba-11 - Report Of Gross Earnings - Railroad Retirement

ADVERTISEMENT

FORM APROVED

UNITED STATES OF AMERICA

OMB NO. 3220-0132

RAILROAD RETIREMENT

1. YEAR

2. EMPLOYER BA NO.

3. PAGE NUMBER

4. TYPE OF REPORT

REPORT OF GROSS EARNINGS

(Monthly, Quarterly or

(SEE INSTRUCTIONS FOR COMPLETING AND MAILING THIS FORM ON REVERSE SIDE)

Annual Breakdown)

The purpose of this report is to obtain the gross earnings for a sample of employees. This information

is required for computation of the Financial Interchange with the Social Security Administration and the

Centers for Medicare & Medicaid Services. The report is required by law under Section 7(b)(6) of the

5a. NAME OF EMPLOYER

Railroad Retirement Act. Failure to report or the making of a false or fraudulent report can result in

criminal prosecution or civil penalties, or both.

5b. OTHER NAME, IF ANY

FORM G-440, REPORT SPECIFICATIONS SHEET, MUST ACCOMPANY THIS FORM.

GROSS EARNINGS AMOUNTS

6.

7.

8(a)

8(b)

8(c)

8(d)

8(e)

8(f)

8(g)

8(h)

8(i)

8(j)

8(k)

8(l)

ANNUAL

EMPLOYEE

EMPLOYEE

NAME

1ST

2ND

3RD

4TH

SOCIAL

(Last Name;

QUARTER

QUARTER

QUARTER

QUARTER

SECURITY

First Name; and

NUMBER

JANUARY

FEBRUARY

MARCH

APRIL

MAY

JUNE

JULY

AUGUST

SEPTEMBER

OCTOBER

NOVEMBER

DECEMBER

Middle Initial)

For RRB

11-19

20-55

56-64

65-73

74-82

83-91

92-100

101-109

56-64

65-73

74-82

83-91

92-100

101-109

Use Only

Form BA-11 (01-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2