Form Ud-20 - Statement Of Gross Earnings And Computation Of Inspection Fee

ADVERTISEMENT

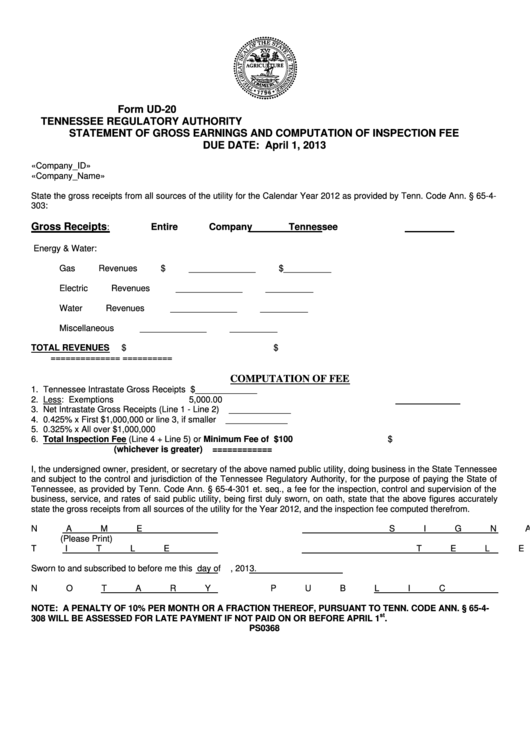

Form UD-20

TENNESSEE REGULATORY AUTHORITY

STATEMENT OF GROSS EARNINGS AND COMPUTATION OF INSPECTION FEE

DUE DATE: April 1, 2013

«Company_ID»

«Company_Name»

State the gross receipts from all sources of the utility for the Calendar Year 2012 as provided by Tenn. Code Ann. § 65-4-

303:

Gross Receipts

Entire Company

Tennessee

:

Energy & Water:

Gas Revenues

$ ______________

$__________

Electric Revenues

______________

__________

Water Revenues

______________

__________

Miscellaneous

______________

__________

TOTAL REVENUES

$

$

==============

==========

COMPUTATION OF FEE

1. Tennessee Intrastate Gross Receipts

$_____________

2. Less: Exemptions

5,000.00

3. Net Intrastate Gross Receipts (Line 1 - Line 2)

_____________

4. 0.425% x First $1,000,000 or line 3, if smaller

_____________

5. 0.325% x All over $1,000,000

6. Total Inspection Fee (Line 4 + Line 5) or Minimum Fee of $100

$

(whichever is greater)

============

I, the undersigned owner, president, or secretary of the above named public utility, doing business in the State Tennessee

and subject to the control and jurisdiction of the Tennessee Regulatory Authority, for the purpose of paying the State of

Tennessee, as provided by Tenn. Code Ann. § 65-4-301 et. seq., a fee for the inspection, control and supervision of the

business, service, and rates of said public utility, being first duly sworn, on oath, state that the above figures accurately

state the gross receipts from all sources of the utility for the Year 2012, and the inspection fee computed therefrom.

NAME

SIGNATURE

(Please Print)

TITLE

TELEPHONE

Sworn to and subscribed to before me this

day of

, 2013.

NOTARY PUBLIC

My Commission Expires

NOTE: A PENALTY OF 10% PER MONTH OR A FRACTION THEREOF, PURSUANT TO TENN. CODE ANN. § 65-4-

st

308 WILL BE ASSESSED FOR LATE PAYMENT IF NOT PAID ON OR BEFORE APRIL 1

.

PS0368

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1