Form Pv-Pp-57 - Military Affidavit For Personal Property Tax Exemption

ADVERTISEMENT

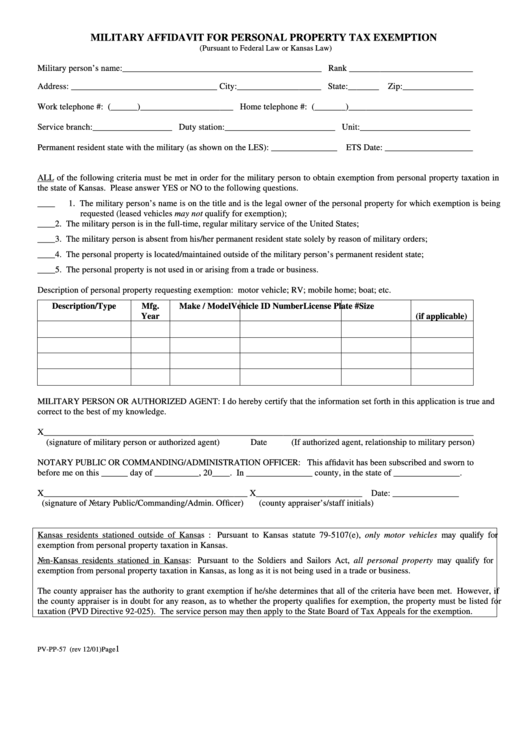

MILITARY AFFIDAVIT FOR PERSONAL PROPERTY TAX EXEMPTION

(Pursuant to Federal Law or Kansas Law)

Military person’s name:_____________________________________________ Rank ____________________________

Address: _________________________________ City:___________________ State:_______ Zip:________________

Work telephone #: (______)_____________________ Home telephone #: (_______)____________________________

Service branch:__________________ Duty station:_________________________ Unit:_________________________

Permanent resident state with the military (as shown on the LES): _______________ ETS Date: ____________________

ALL of the following criteria must be met in order for the military person to obtain exemption from personal property taxation in

the state of Kansas. Please answer YES or NO to the following questions.

____

1. The military person’s name is on the title and is the legal owner of the personal property for which exemption is being

requested (leased vehicles may not qualify for exemption);

____

2. The military person is in the full-time, regular military service of the United States;

____

3. The military person is absent from his/her permanent resident state solely by reason of military orders;

____

4. The personal property is located/maintained outside of the military person’s permanent resident state;

____

5. The personal property is not used in or arising from a trade or business.

Description of personal property requesting exemption: motor vehicle; RV; mobile home; boat; etc.

Description/Type

Mfg.

Make / Model

Vehicle ID Number

License Plate #

Size

Year

(if applicable)

MILITARY PERSON OR AUTHORIZED AGENT: I do hereby certify that the information set forth in this application is true and

correct to the best of my knowledge.

X_________________________________________________________________________________________________

(signature of military person or authorized agent)

Date

(If authorized agent, relationship to military person)

NOTARY PUBLIC OR COMMANDING/ADMINISTRATION OFFICER: This affidavit has been subscribed and sworn to

before me on this ______ day of __________, 20____. In _______________ county, in the state of _______________.

X______________________________________________

X________________________ Date: _______________

(signature of Notary Public/Commanding/Admin. Officer)

(county appraiser’s/staff initials)

Kansas residents stationed outside of Kansas : Pursuant to Kansas statute 79-5107(e), only motor vehicles may qualify for

exemption from personal property taxation in Kansas.

Non-Kansas residents stationed in Kansas: Pursuant to the Soldiers and Sailors Act, all personal property may qualify for

exemption from personal property taxation in Kansas, as long as it is not being used in a trade or business.

The county appraiser has the authority to grant exemption if he/she determines that all of the criteria have been met. However, if

the county appraiser is in doubt for any reason, as to whether the property qualifies for exemption, the property must be listed for

taxation (PVD Directive 92-025). The service person may then apply to the State Board of Tax Appeals for the exemption.

1

PV-PP-57 (rev 12/01)

Page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2

![Form Rp-421-i [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-i [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3207/320781/page_1_thumb.png)

![Form Rp-421-i [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-i [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3208/320837/page_1_thumb.png)

![Form Rp-421-j [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-j [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3208/320854/page_1_thumb.png)