Form Rp-420-A-Org - Application For Real Property Tax Exemption For Nonprofit Organizations - Mandatory Class I-Organization Purpose - 2008

ADVERTISEMENT

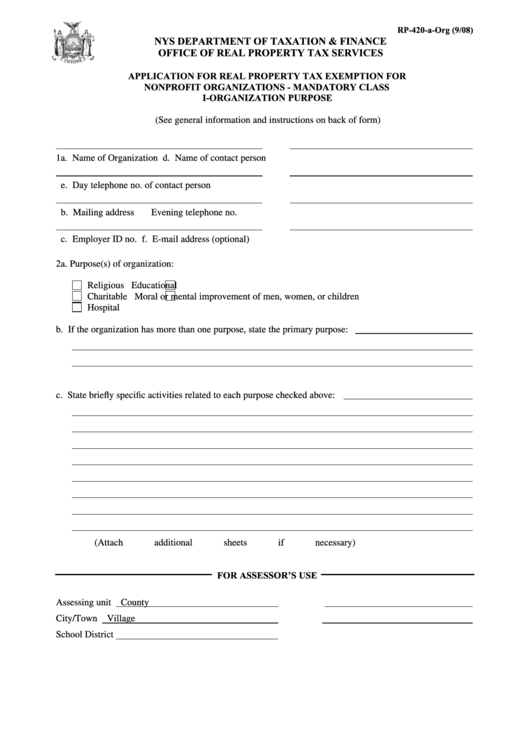

RP-420-a-Org (9/08)

NYS DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR

NONPROFIT ORGANIZATIONS - MANDATORY CLASS

I-ORGANIZATION PURPOSE

(See general information and instructions on back of form)

1a. Name of Organization

d. Name of contact person

e. Day telephone no. of contact person

b. Mailing address

Evening telephone no.

c. Employer ID no.

f. E-mail address (optional)

2a. Purpose(s) of organization:

Religious

Educational

Charitable

Moral or mental improvement of men, women, or children

Hospital

b. If the organization has more than one purpose, state the primary purpose:

c. State briefly specific activities related to each purpose checked above:

(Attach additional sheets if necessary)

FOR ASSESSOR’S USE

Assessing unit

County

City/Town

Village

School District

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4