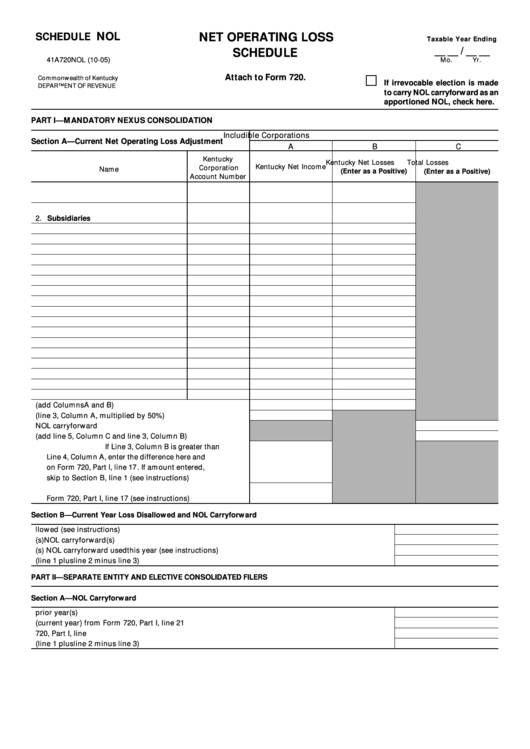

Schedule Nol - Net Operating Loss Schedule - 2005

ADVERTISEMENT

NOL

SCHEDULE

NET OPERATING LOSS

Taxable Year Ending

__ __ / __ __

SCHEDULE

41A720NOL (10-05)

Mo.

Yr.

Attach to Form 720.

Commonwealth of Kentucky

If irrevocable election is made

DEPARTMENT OF REVENUE

to carry NOL carryforward as an

apportioned NOL, check here.

PART I—MANDATORY NEXUS CONSOLIDATION

Includible Corporations

Section A—Current Net Operating Loss Adjustment

A

B

C

Kentucky

Kentucky Net Losses

Total Losses

Kentucky Net Income

Corporation

Name

(Enter as a Positive)

(Enter as a Positive)

Account Number

1. Common Parent

2. Subsidiaries

3. Totals (add Columns A and B) ............................................

4. Limitation (line 3, Column A, multiplied by 50%) .............

5. Prior year NOL carryforward ...............................................

6. Total (add line 5, Column C and line 3, Column B) ...........

7. Disallowed loss. If Line 3, Column B is greater than

Line 4, Column A, enter the difference here and

on Form 720, Part I, line 17. If amount entered,

skip to Section B, line 1 (see instructions) .........................

8. Additional NOLD. Enter as a negative amount on

Form 720, Part I, line 17 (see instructions) .........................

Section B—Current Year Loss Disallowed and NOL Carryforward

1. Current year loss disallowed (see instructions) .......................................................................................

2. Prior year(s) NOL carryforward(s) .............................................................................................................

3. Prior year(s) NOL carryforward used this year (see instructions) ..........................................................

4. Total NOL carryforward (line 1 plus line 2 minus line 3) .........................................................................

PART II—SEPARATE ENTITY AND ELECTIVE CONSOLIDATED FILERS

Section A—NOL Carryforward

1. Carryforward from prior year(s) ................................................................................................................

2. Net operating loss (current year) from Form 720, Part I, line 21 ............................................................

3. Net operating loss deduction from Form 720, Part I, line 20 ..................................................................

4. Total NOL carryforward (line 1 plus line 2 minus line 3) .........................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1