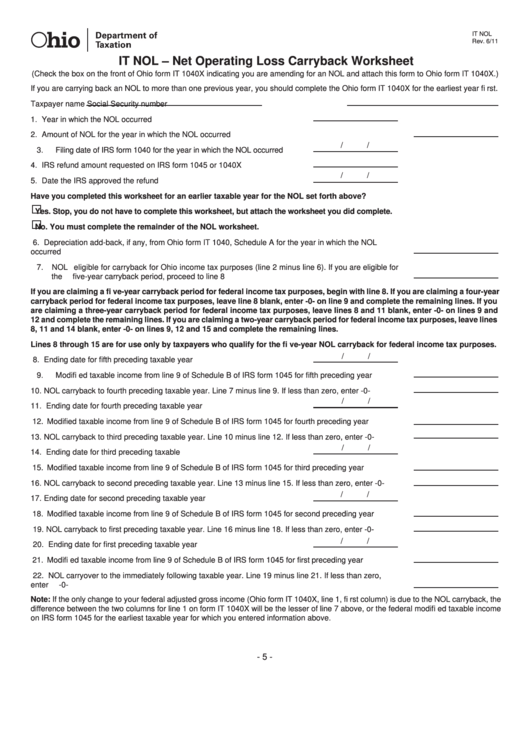

Form It Nol - Net Operating Loss Carryback Worksheet

ADVERTISEMENT

IT NOL

Rev. 6/11

IT NOL – Net Operating Loss Carryback Worksheet

(Check the box on the front of Ohio form IT 1040X indicating you are amending for an NOL and attach this form to Ohio form IT 1040X.)

If you are carrying back an NOL to more than one previous year, you should complete the Ohio form IT 1040X for the earliest year fi rst.

Taxpayer name

Social Security number

1. Year in which the NOL occurred .................................................................... 1.

2. Amount of NOL for the year in which the NOL occurred ............................................................................. 2.

/

/

3. Filing date of IRS form 1040 for the year in which the NOL occurred ............. 3.

4. IRS refund amount requested on IRS form 1045 or 1040X .......................... 4.

/

/

5. Date the IRS approved the refund request.................................................... 5.

Have you completed this worksheet for an earlier taxable year for the NOL set forth above?

Yes. Stop, you do not have to complete this worksheet, but attach the worksheet you did complete.

No. You must complete the remainder of the NOL worksheet.

6. Depreciation add-back, if any, from Ohio form IT 1040, Schedule A for the year in which the NOL

occurred ...................................................................................................................................................... 6.

7. NOL eligible for carryback for Ohio income tax purposes (line 2 minus line 6). If you are eligible for

the fi ve-year carryback period, proceed to line 8 ........................................................................................ 7.

If you are claiming a fi ve-year carryback period for federal income tax purposes, begin with line 8. If you are claiming a four-year

carryback period for federal income tax purposes, leave line 8 blank, enter -0- on line 9 and complete the remaining lines. If you

are claiming a three-year carryback period for federal income tax purposes, leave lines 8 and 11 blank, enter -0- on lines 9 and

12 and complete the remaining lines. If you are claiming a two-year carryback period for federal income tax purposes, leave lines

8, 11 and 14 blank, enter -0- on lines 9, 12 and 15 and complete the remaining lines.

Lines 8 through 15 are for use only by taxpayers who qualify for the fi ve-year NOL carryback for federal income tax purposes.

/

/

8. Ending date for fi fth preceding taxable year .................................................. 8.

9. Modifi ed taxable income from line 9 of Schedule B of IRS form 1045 for fi fth preceding year ................... 9.

10. NOL carryback to fourth preceding taxable year. Line 7 minus line 9. If less than zero, enter -0- ............ 10.

/

/

11. Ending date for fourth preceding taxable year ............................................ 11.

12. Modifi ed taxable income from line 9 of Schedule B of IRS form 1045 for fourth preceding year .............. 12.

13. NOL carryback to third preceding taxable year. Line 10 minus line 12. If less than zero, enter -0- .......... 13.

/

/

14. Ending date for third preceding taxable year............................................... 14.

15. Modifi ed taxable income from line 9 of Schedule B of IRS form 1045 for third preceding year ................ 15.

16. NOL carryback to second preceding taxable year. Line 13 minus line 15. If less than zero, enter -0- ...... 16.

/

/

17. Ending date for second preceding taxable year .......................................... 17.

18. Modifi ed taxable income from line 9 of Schedule B of IRS form 1045 for second preceding year ........... 18.

19. NOL carryback to fi rst preceding taxable year. Line 16 minus line 18. If less than zero, enter -0- ........... 19.

/

/

20. Ending date for fi rst preceding taxable year ................................................ 20.

21. Modifi ed taxable income from line 9 of Schedule B of IRS form 1045 for fi rst preceding year ................. 21.

22. NOL carryover to the immediately following taxable year. Line 19 minus line 21. If less than zero,

enter -0- ..................................................................................................................................................... 22.

Note: If the only change to your federal adjusted gross income (Ohio form IT 1040X, line 1, fi rst column) is due to the NOL carryback, the

difference between the two columns for line 1 on form IT 1040X will be the lesser of line 7 above, or the federal modifi ed taxable income

on IRS form 1045 for the earliest taxable year for which you entered information above.

- 5 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1