Instructions For Withholding Tax Reconciliation (W-3) - City Of Springfield

ADVERTISEMENT

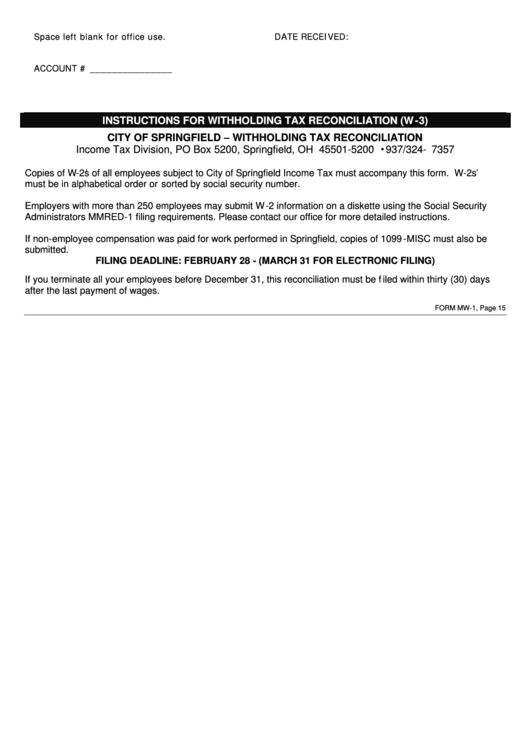

Space left blank for office use.

DATE RECEIVED:

ACCOUNT # _______________

INSTRUCTIONS FOR WITHHOLDING TAX RECONCILIATION (W-3)

CITY OF SPRINGFIELD

WITHHOLDING TAX RECONCILIATION

Income Tax Division, PO Box 5200, Springfield, OH 45501-5200

937/324-7357

Copies of W-2 s of all employees subject to City of Springfield Income Tax must accompany this form. W-2 s

must be in alphabetical order or sorted by social security number.

Employers with more than 250 employees may submit W-2 information on a diskette using the Social Security

Administrators MMRED-1 filing requirements. Please contact our office for more detailed instructions.

If non-employee compensation was paid for work performed in Springfield, copies of 1099-MISC must also be

submitted.

FILING DEADLINE: FEBRUARY 28 - (MARCH 31 FOR ELECTRONIC FILING)

If you terminate all your employees before December 31, this reconciliation must be filed within thirty (30) days

after the last payment of wages.

FORM MW-1, Page 15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1