Instructions For Withholding Tax Form Wv/it-102/w-2 2002

ADVERTISEMENT

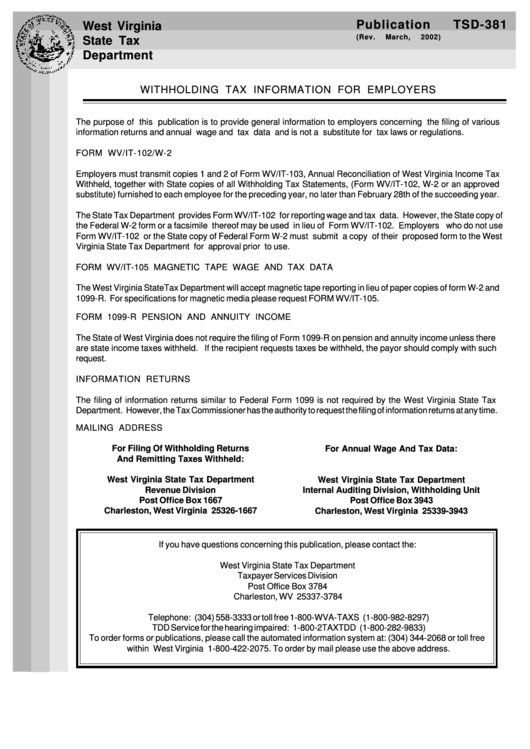

Publication

TSD-381

West Virginia

(Rev.

March,

2002)

State Tax

Department

WITHHOLDING TAX INFORMATION FOR EMPLOYERS

The purpose of this publication is to provide general information to employers concerning the filing of various

information returns and annual wage and tax data and is not a substitute for tax laws or regulations.

FORM WV/IT-102/W-2

Employers must transmit copies 1 and 2 of Form WV/IT-103, Annual Reconciliation of West Virginia Income Tax

Withheld, together with State copies of all Withholding Tax Statements, (Form WV/IT-102, W-2 or an approved

substitute) furnished to each employee for the preceding year, no later than February 28th of the succeeding year.

The State Tax Department provides Form WV/IT-102 for reporting wage and tax data. However, the State copy of

the Federal W-2 form or a facsimile thereof may be used in lieu of Form WV/IT-102. Employers who do not use

Form WV/IT-102 or the State copy of Federal Form W-2 must submit a copy of their proposed form to the West

Virginia State Tax Department for approval prior to use.

FORM WV/IT-105 MAGNETIC TAPE WAGE AND TAX DATA

The West Virginia StateTax Department will accept magnetic tape reporting in lieu of paper copies of form W-2 and

1099-R. For specifications for magnetic media please request FORM WV/IT-105.

FORM 1099-R PENSION AND ANNUITY INCOME

The State of West Virginia does not require the filing of Form 1099-R on pension and annuity income unless there

are state income taxes withheld. If the recipient requests taxes be withheld, the payor should comply with such

request.

INFORMATION RETURNS

The filing of information returns similar to Federal Form 1099 is not required by the West Virginia State Tax

Department. However, the Tax Commissioner has the authority to request the filing of information returns at any time.

MAILING ADDRESS

For Filing Of Withholding Returns

For Annual Wage And Tax Data:

And Remitting Taxes Withheld:

West Virginia State Tax Department

West Virginia State Tax Department

Revenue Division

Internal Auditing Division, Withholding Unit

Post Office Box 1667

Post Office Box 3943

Charleston, West Virginia 25326-1667

Charleston, West Virginia 25339-3943

If you have questions concerning this publication, please contact the:

West Virginia State Tax Department

Taxpayer Services Division

Post Office Box 3784

Charleston, WV 25337-3784

Telephone: (304) 558-3333 or toll free 1-800-WVA-TAXS (1-800-982-8297)

TDD Service for the hearing impaired: 1-800-2TAXTDD (1-800-282-9833)

To order forms or publications, please call the automated information system at: (304) 344-2068 or toll free

within West Virginia 1-800-422-2075. To order by mail please use the above address.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1