Report For Tax On Meals And Beverages Sold Form - City Of Alexandria, Virginia

ADVERTISEMENT

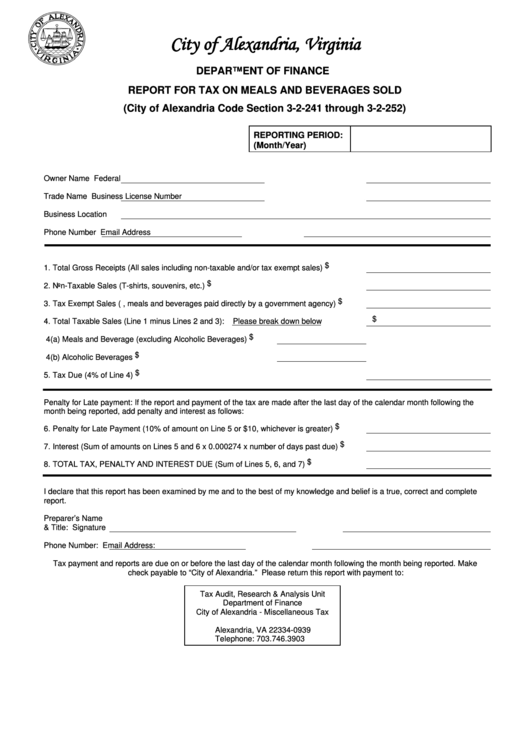

City of Alexandria, Virginia

DEPARTMENT OF FINANCE

REPORT FOR TAX ON MEALS AND BEVERAGES SOLD

(City of Alexandria Code Section 3-2-241 through 3-2-252)

REPORTING PERIOD:

(Month/Year)

Owner Name

Federal I.D. Number

Trade Name

Business License Number

Business Location

Phone Number

Email Address

$

1. Total Gross Receipts (All sales including non-taxable and/or tax exempt sales)

$

2. Non-Taxable Sales (T-shirts, souvenirs, etc.)

$

3. Tax Exempt Sales (i.e., meals and beverages paid directly by a government agency)

$

4. Total Taxable Sales (Line 1 minus Lines 2 and 3):

Please break down below

$

4(a) Meals and Beverage (excluding Alcoholic Beverages)

$

4(b) Alcoholic Beverages

$

5. Tax Due (4% of Line 4)

Penalty for Late payment: If the report and payment of the tax are made after the last day of the calendar month following the

month being reported, add penalty and interest as follows:

$

6. Penalty for Late Payment (10% of amount on Line 5 or $10, whichever is greater)

$

7. Interest (Sum of amounts on Lines 5 and 6 x 0.000274 x number of days past due)

$

8. TOTAL TAX, PENALTY AND INTEREST DUE (Sum of Lines 5, 6, and 7)

I declare that this report has been examined by me and to the best of my knowledge and belief is a true, correct and complete

report.

Preparer’s Name

& Title:

Signature

Phone Number:

Email Address:

Tax payment and reports are due on or before the last day of the calendar month following the month being reported. Make

check payable to “City of Alexandria.” Please return this report with payment to:

Tax Audit, Research & Analysis Unit

Department of Finance

City of Alexandria - Miscellaneous Tax

P.O. Box 34939

Alexandria, VA 22334-0939

Telephone: 703.746.3903

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1