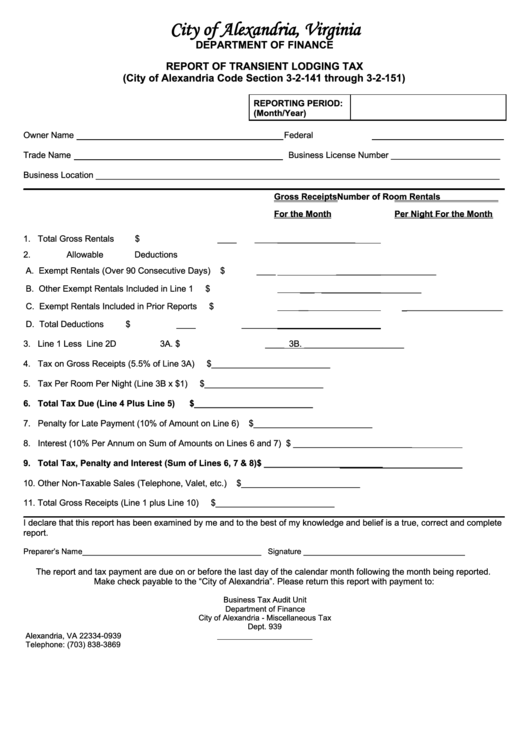

City of Alexandria, Virginia

DEPARTMENT OF FINANCE

REPORT OF TRANSIENT LODGING TAX

(City of Alexandria Code Section 3-2-141 through 3-2-151)

REPORTING PERIOD:

(Month/Year)

Owner Name

Federal I.D. Number ___________________________

Trade Name

Business License Number _______________________

Business Location _____________________________________________________________________________________

____________________________________________________________________________________________________

Gross Receipts

Number of Room Rentals

For the Month

Per Night For the Month

1. Total Gross Rentals

$

____

_______________________

2. Allowable Deductions

A. Exempt Rentals (Over 90 Consecutive Days)

$

____

_____________________

B. Other Exempt Rentals Included in Line 1

$

___

_____________________

C. Exempt Rentals Included in Prior Reports

$

__

_____________________

D. Total Deductions

$

____

_____________________

3. Line 1 Less Line 2D

3A. $

____ 3B. _____________________

4. Tax on Gross Receipts (5.5% of Line 3A)

$_________________________

5. Tax Per Room Per Night (Line 3B x $1)

$_________________________

6. Total Tax Due (Line 4 Plus Line 5)

$_________________________

7. Penalty for Late Payment (10% of Amount on Line 6)

$_________________________

8. Interest (10% Per Annum on Sum of Amounts on Lines 6 and 7)

$ _________________________

9. Total Tax, Penalty and Interest (Sum of Lines 6, 7 & 8)

$ _________________________

10. Other Non-Taxable Sales (Telephone, Valet, etc.)

$_________________________

11. Total Gross Receipts (Line 1 plus Line 10)

$_________________________

____________________________________________________________________________________________________

I declare that this report has been examined by me and to the best of my knowledge and belief is a true, correct and complete

report.

Preparer’s Name_________________________________________ Signature _____________________________________

The report and tax payment are due on or before the last day of the calendar month following the month being reported.

Make check payable to the “City of Alexandria”. Please return this report with payment to:

Business Tax Audit Unit

Department of Finance

City of Alexandria - Miscellaneous Tax

Dept. 939

Alexandria, VA 22334-0939

Telephone: (703) 838-3869

1

1