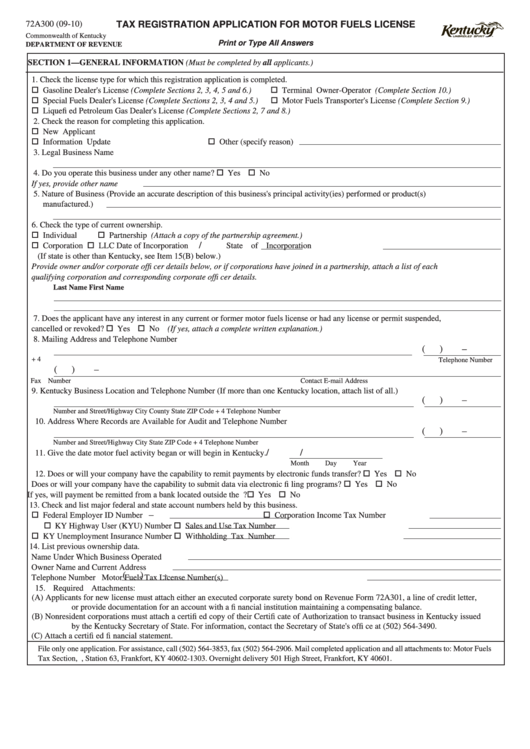

Form 72a300 - Tax Registration Application For Motor Fuels License

ADVERTISEMENT

72A300 (09-10)

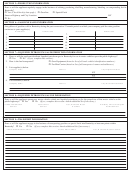

TAX REGISTRATION APPLICATION FOR MOTOR FUELS LICENSE

Commonwealth of Kentucky

Print or Type All Answers

DEPARTMENT OF REVENUE

SECTION 1—GENERAL INFORMATION (Must be completed by all applicants.)

1. Check the license type for which this registration application is completed.

Gasoline Dealer's License (Complete Sections 2, 3, 4, 5 and 6.)

Terminal Owner-Operator (Complete Section 10.)

Special Fuels Dealer's License (Complete Sections 2, 3, 4 and 5.)

Motor Fuels Transporter's License (Complete Section 9.)

Liquefi ed Petroleum Gas Dealer's License (Complete Sections 2, 7 and 8.)

2. Check the reason for completing this application.

New Applicant

Other (specify reason)

Information Update

3. Legal Business Name

4. Do you operate this business under any other name?

Yes

No

If yes, provide other name

5. Nature of Business (Provide an accurate description of this business's principal activity(ies) performed or product(s)

manufactured.)

6. Check the type of current ownership.

Individual

Partnership (Attach a copy of the partnership agreement.)

/

Corporation

LLC

Date of Incorporation

State of Incorporation

(If state is other than Kentucky, see Item 15(B) below.)

Provide owner and/or corporate offi cer details below, or if corporations have joined in a partnership, attach a list of each

qualifying corporation and corresponding corporate offi cer details.

Last Name

First Name

M.I.

Title

Residence Address

Social Security Number

7. Does the applicant have any interest in any current or former motor fuels license or had any license or permit suspended,

cancelled or revoked?

Yes

No (If yes, attach a complete written explanation.)

8. Mailing Address and Telephone Number

(

)

–

P.O. Box or Number and Street/Highway

City

State

ZIP Code + 4

Telephone Number

(

)

–

Fax Number

Contact E-mail Address

9. Kentucky Business Location and Telephone Number (If more than one Kentucky location, attach list of all.)

(

)

–

Number and Street/Highway

City

County

State

ZIP Code + 4

Telephone Number

10. Address Where Records are Available for Audit and Telephone Number

(

)

–

Number and Street/Highway

City

State

ZIP Code + 4

Telephone Number

/

/

11. Give the date motor fuel activity began or will begin in Kentucky.

Month

Day

Year

12. Does or will your company have the capability to remit payments by electronic funds transfer?

Yes

No

Does or will your company have the capability to submit data via electronic fi ling programs?

Yes

No

If yes, will payment be remitted from a bank located outside the U.S.?

Yes

No

13. Check and list major federal and state account numbers held by this business.

–

Federal Employer ID Number

Corporation Income Tax Number

KY Highway User (KYU) Number

Sales and Use Tax Number

KY Unemployment Insurance Number

Withholding Tax Number

14. List previous ownership data.

Name Under Which Business Operated

Owner Name and Current Address

(

)

–

Telephone Number

Motor Fuels Tax License Number(s)

15. Required Attachments:

(A) Applicants for new license must attach either an executed corporate surety bond on Revenue Form 72A301, a line of credit letter,

or provide documentation for an account with a fi nancial institution maintaining a compensating balance.

(B) Nonresident corporations must attach a certifi ed copy of their Certifi cate of Authorization to transact business in Kentucky issued

by the Kentucky Secretary of State. For information, contact the Secretary of State's offi ce at (502) 564-3490.

(C) Attach a certifi ed fi nancial statement.

File only one application. For assistance, call (502) 564-3853, fax (502) 564-2906. Mail completed application and all attachments to: Motor Fuels

Tax Section, P.O. Box 1303, Station 63, Frankfort, KY 40602-1303. Overnight delivery 501 High Street, Frankfort, KY 40601.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4