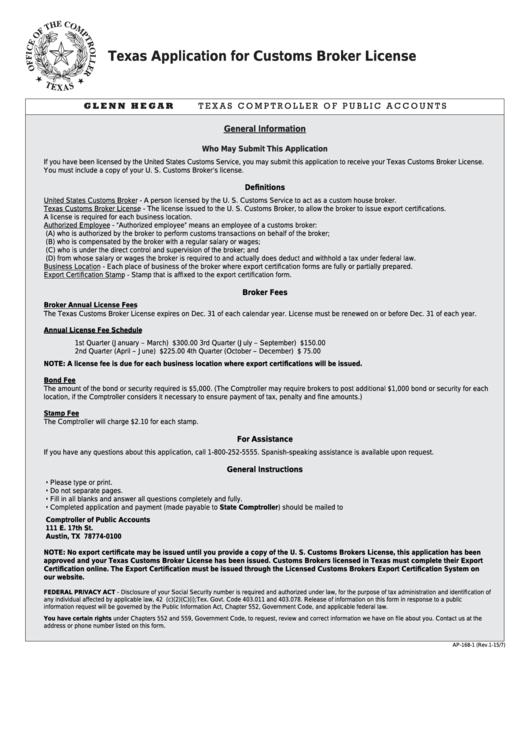

Texas Application for Customs Broker License

G L E N N H E G A R

T E X A S C O M P T R O L L E R O F P U B L I C A C C O U N T S

General Information

Who May Submit This Application

If you have been licensed by the United States Customs Service, you may submit this application to receive your Texas Customs Broker License.

You must include a copy of your U. S. Customs Broker’s license.

Definitions

United States Customs Broker - A person licensed by the U. S. Customs Service to act as a custom house broker.

Texas Customs Broker License - The license issued to the U. S. Customs Broker, to allow the broker to issue export certifications.

A license is required for each business location.

Authorized Employee - “Authorized employee” means an employee of a customs broker:

(A) who is authorized by the broker to perform customs transactions on behalf of the broker;

(B) who is compensated by the broker with a regular salary or wages;

(C) who is under the direct control and supervision of the broker; and

(D) from whose salary or wages the broker is required to and actually does deduct and withhold a tax under federal law.

Business Location - Each place of business of the broker where export certification forms are fully or partially prepared.

Export Certification Stamp - Stamp that is affixed to the export certification form.

Broker Fees

Broker Annual License Fees

The Texas Customs Broker License expires on Dec. 31 of each calendar year. License must be renewed on or before Dec. 31 of each year.

Annual License Fee Schedule

1st Quarter (January – March) ................................. $300.00

3rd Quarter (July – September) ................................ $150.00

2nd Quarter (April – June) ........................................$225.00

4th Quarter (October – December) ............................ $ 75.00

NOTE: A license fee is due for each business location where export certifications will be issued.

Bond Fee

The amount of the bond or security required is $5,000. (The Comptroller may require brokers to post additional $1,000 bond or security for each

location, if the Comptroller considers it necessary to ensure payment of tax, penalty and fine amounts.)

Stamp Fee

The Comptroller will charge $2.10 for each stamp.

For Assistance

If you have any questions about this application, call 1-800-252-5555. Spanish-speaking assistance is available upon request.

General Instructions

• Please type or print.

• Do not separate pages.

• Fill in all blanks and answer all questions completely and fully.

• Completed application and payment (made payable to State Comptroller) should be mailed to

Comptroller of Public Accounts

111 E. 17th St.

Austin, TX 78774-0100

NOTE: No export certificate may be issued until you provide a copy of the U. S. Customs Brokers License, this application has been

approved and your Texas Customs Broker License has been issued. Customs Brokers licensed in Texas must complete their Export

Certification online. The Export Certification must be issued through the Licensed Customs Brokers Export Certification System on

our website.

FEDERAL PRIVACY ACT - Disclosure of your Social Security number is required and authorized under law, for the purpose of tax administration and identification of

any individual affected by applicable law, 42 U.S.C. 405(c)(2)(C)(i);Tex. Govt. Code 403.011 and 403.078. Release of information on this form in response to a public

information request will be governed by the Public Information Act, Chapter 552, Government Code, and applicable federal law.

You have certain rights under Chapters 552 and 559, Government Code, to request, review and correct information we have on file about you. Contact us at the

address or phone number listed on this form.

AP-168-1 (Rev.1-15/7)

1

1 2

2 3

3 4

4