Formit-140nrc - West Virginia Nonresident Composite Incometax Return

ADVERTISEMENT

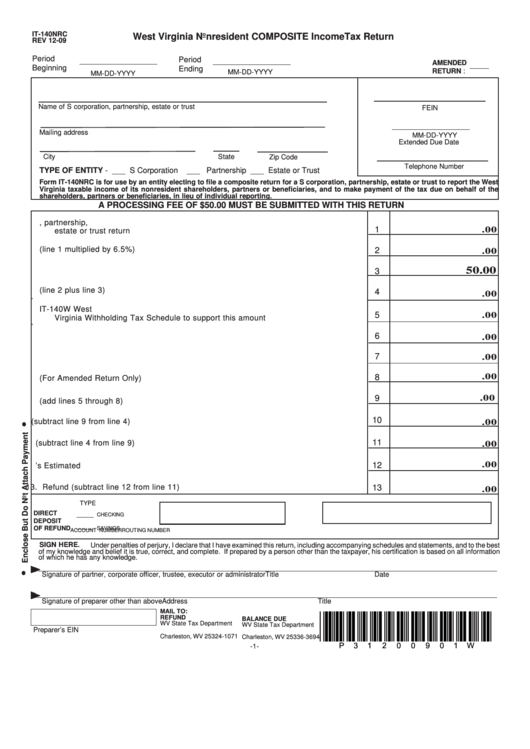

IT-140NRC

West Virginia Nonresident COMPOSITE IncomeTax Return

REV 12-09

Period

Period

AMENDED

Beginning

Ending

RETURN :

MM-DD-YYYY

MM-DD-YYYY

Name of S corporation, partnership, estate or trust

FEIN

Mailing address

MM-DD-YYYY

Extended Due Date

City

State

Zip Code

Telephone Number

TYPE OF ENTITY - ___ S Corporation

___ Partnership ___ Estate or Trust

Form IT-140NRC is for use by an entity electing to file a composite return for a S corporation, partnership, estate or trust to report the West

Virginia taxable income of its nonresident shareholders, partners or beneficiaries, and to make payment of the tax due on behalf of the

shareholders, partners or beneficiaries, in lieu of individual reporting.

A PROCESSING FEE OF $50.00 MUST BE SUBMITTED WITH THIS RETURN

1. Total West Virginia Source Income as reported on S corporation, partnership,

1

.00

estate or trust return ..............................................................................................

2. Tax (line 1 multiplied by 6.5%) ...............................................................................

2

.00

50.00

3

3. Composite Return Processing Fee.........................................................................

4. Total Taxes and Fees Due (line 2 plus line 3) ........................................................

4

.00

.

5. West Virginia Income Tax Withheld - You must complete the IT-140W West

5

.00

Virginia Withholding Tax Schedule to support this amount.....................................

.

6. Estimated Tax Payments and payments made with extensions of time. .................

6

.00

7. Business Tax/Investment/Employment Credits.......................................................

7

.00

.00

8

8. Payment Made With Original Return (For Amended Return Only)...........................

9

.00

9. Sum of Payments (add lines 5 through 8) ..............................................................

10

10. Balance Due the State (subtract line 9 from line 4).................................................

.00

11

11. Overpayment (subtract line 4 from line 9)...............................................................

.00

.00

12

12. Credit to Next Year’s Estimated Tax.......................................................................

13. Refund (subtract line 12 from line 11).....................................................................

13

.00

TYPE

DIRECT

CHECKING

DEPOSIT

OF REFUND

SAVINGS

ROUTING NUMBER

ACCOUNT NUMBER

SIGN HERE.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best

of my knowledge and belief it is true, correct, and complete. If prepared by a person other than the taxpayer, his certification is based on all information

of which he has any knowledge.

Signature of partner, corporate officer, trustee, executor or administrator

Title

Date

Signature of preparer other than above

Address

Title

MAIL TO:

REFUND

BALANCE DUE

*P31200901w*

WV State Tax Department

WV State Tax Department

Preparer’s EIN

P.O. Box 1071

P.O. Box 3694

Charleston, WV 25324-1071

Charleston, WV 25336-3694

-1-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1