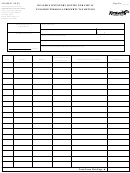

Tangible Personal Property Tax Return Form Page 2

ADVERTISEMENT

NAME OF BUSINESS

ACCOUNT NUMBER

YEAR

TANGIBLE PERSONAL PROPERTY TAX SCHEDULES

PAGE 2

(ENTER TOTALS ON PAGE 1)

ASSETS PHYSICALLY REMOVED DURING LAST YEAR

(Disposals ONLY)

DISPOSITION INFORMATION

Property Fully Depreciated but Continuing in Service Must be Reported on the Schedules Below.

(If sold, please attach a copy of sales/purchase

agreement with schedules and name, address

YEAR

TAXPAYER’S ESTIMATE

ORIGINAL

and phone number of buyer)

DESCRIPTION OF ITEM

AGE

ACQ.

OF FAIR MARKET VALUE

INSTALLED COST

LEASED, LOANED AND RENTED EQUIPMENT

(Please complete if you hold equipment belonging to others)

YEAR

YEAR OF

RENT

RETAIL INSTALLED

NAME AND ADDRESS OF OWNER OR LESSOR

DESCRIPTION

ACQUIRED

MFG.

PER MONTH

COST NEW

APPRAISER’S USE ONLY

LINE ______ Enter Applicable Line Number (8-19) From Page 1

TAXPAYER’S ESTIMATE

YEAR

TAXPAYER’S ESTIMATE

OF CONDITION

ORIGINAL

DESCRIPTION OF ITEM

AGE

ACQ.

OF FAIR MARKET VALUE

GOOD AVG. POOR

INSTALLED COST

CONDITION

Enter TOTALS on Front

- Continue on Separate Sheet if Necessary

LINE ______ Enter Applicable Line Number (8-19) From Page 1

Enter TOTALS on Front

- Continue on Separate Sheet if Necessary

LINE ______ Enter Applicable Line Number (8-19) From Page 1

Enter TOTALS on Front

- Continue on Separate Sheet if Necessary

LINE 17

EQUIPMENT OWNED BY YOU BUT RENTED, LEASED OR HELD BY OTHERS

TAXPAYER’S

TAXPAYER’S

ESTIMATE OF

ESTIMATE OF

RETAIL

NAME/ADDRESS OF LESSEE

YEAR

RENT

FAIR MARKET

CONDITION

INSTALLED

LEASE NO.

ACTUAL PHYSICAL LOCATION

DESCRIPTION OF ITEM

AGE

ACQ. PER MO. TERM

VALUE

GOOD AVG. POOR

COST NEW

Enter TOTALS on Front

- Continue on Separate Sheet if Necessary

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2