Form Dr 0900p - Pass-Through Entity - Income Tax Payment Voucher - 2010

ADVERTISEMENT

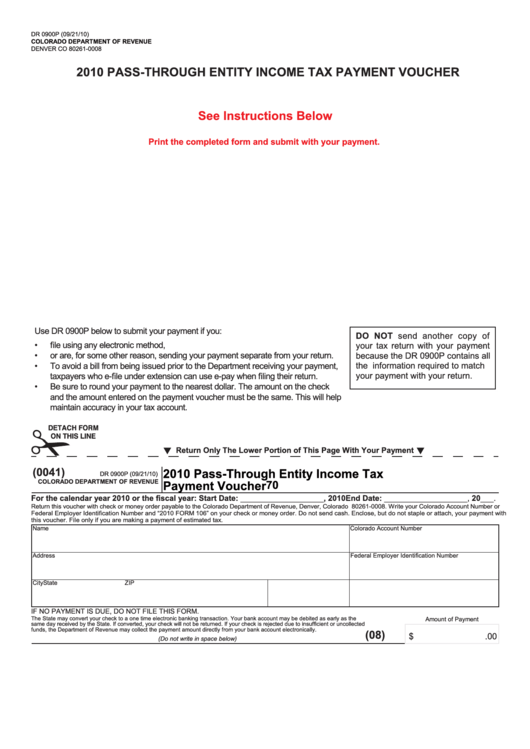

DR 0900P (09/21/10)

COLORADO DepARtment OF ReVenUe

DenveR CO 80261-0008

2010 pASS-tHROUGH entItY InCOme tAx pAYment VOUCHeR

See Instructions Below

print the completed form and submit with your payment.

Use DR 0900P below to submit your payment if you:

DO nOt send another copy of

•

file using any electronic method,

your tax return with your payment

•

or are, for some other reason, sending your payment separate from your return.

because the DR 0900P contains all

•

To avoid a bill from being issued prior to the Department receiving your payment,

the information required to match

your payment with your return.

taxpayers who e-file under extension can use e-pay when filing their return.

•

Be sure to round your payment to the nearest dollar. The amount on the check

and the amount entered on the payment voucher must be the same. This will help

maintain accuracy in your tax account.

DETACH FORM

ON THIS LINE

Return Only the Lower portion of this page With Your payment

(0041)

2010 pass-through entity Income tax

DR 0900P (09/21/10)

70

COLORADO DepARtment OF ReVenUe

payment Voucher

For the calendar year 2010 or the fiscal year: Start Date: ___________________, 2010 End Date: ___________________, 20___.

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-0008. Write your Colorado Account Number or

Federal Employer Identification Number and “2010 FORM 106” on your check or money order. Do not send cash. Enclose, but do not staple or attach, your payment with

this voucher. File only if you are making a payment of estimated tax.

name

Colorado Account Number

Address

Federal Employer Identification Number

City

State

ZIP

IF NO PAYMENT IS DUE, DO NOT FILE THIS FORM.

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the

Amount of Payment

same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected

funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

(08)

$

.00

(Do not write in space below)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1