Form 502w - Virginia Pass-Through Entity Withholding Tax Payment

ADVERTISEMENT

Pass-Through Entity Withholding Tax Payment

Purpose of form: For taxable years beginning on or after January

purpose or activities. The exemption from federal income

1, 2008, every pass-through entity (PTE) doing business in the

tax must apply to the entity’s share of the PTE’s income.

Commonwealth that has taxable income derived from Virginia

Examples of such exempt entities are:

sources and that must allocate any portion of that income to a

Other PTEs. Generally, a PTE does not need to withhold

nonresident owner is required to pay the withholding tax. The PTE

for a nonresident owner that is also a PTE. These

withholds and remits tax using payment voucher, Form 502W.

nonresident owner PTEs are responsible for filing their

Form 502W is used to make a withholding payment prior to filing

own PTE returns of income and must pay the withholding

the return of income, Form 502. This will occur most often when

tax for their nonresident owners’ shares of income from

the PTE utilizes the automatic extension to file. Form 502W can

Virginia sources. If a PTE is notified by a nonresident

also be used to make a withholding payment prior to the due date.

owner PTE that the nonresident owner PTE is not going

Do not enclose Form 502W with your return (Form 502). Instead,

to file a Virginia PTE return, then the PTE is required to

use Form 502V, payment voucher, to make payments with your

withhold on the nonresident owner PTE.

return.

Caution: If a PTE withholds on a nonresident owner PTE,

Amount of withholding tax: The PTE is required to withhold

the nonresident owner PTE cannot claim credit on its

tax of five percent of the share of taxable income from Virginia

Virginia 502 return for such withholding. PTE withholding

sources that is allocable to each nonresident owner. The amount

is not “generation skipping” and does not pass through

of withholding tax may be reduced by any tax credits earned by

an intermediate PTE to owners that are more than one

the PTE and allowable by the Code of Virginia that pass through

level of ownership away. In the event a PTE erroneously

to nonresident owners. The credit or credits may not reduce the

withholds for a nonresident owner PTE, the PTE should

tax liability of any nonresident owner to less than zero; nor may

file an amended Form 502. See Page 4 of Form 502

any unused credit be carried over on a unified return.

instructions (Amended Returns) for additional information.

Exempt Entities: The PTE will not be required to pay the

Entities exempt by reason of diplomatic immunity or

withholding tax if it:

pursuant to treaties between the United States and other

• Is a Publicly Traded Partnership

countries. An entity claiming this exemption must provide

a statement to the PTE stating that it has diplomatic

• Is a Disregarded Entity

immunity from federal income tax.

• Files a Unified Return on Behalf of All Non-resident Owners

• Real estate investment trusts (REITs) except Captive

Undue Hardship: If a PTE believes that the withholding

REITs.

requirement causes an undue hardship, the PTE may apply to

• Corporations that are exempt from Virginia income tax:

the Tax Commissioner requesting an exemption. In addition to any

Examples of such exempt corporations are:

other information that is pertinent to the PTE’s petition for relief, the

letter shall provide information to enable the Tax Commissioner to

Certain banks, insurance companies and public utilities

compare and evaluate the cost to the PTE of complying with the

that are subject to other taxes in lieu of Virginia income

withholding tax requirements and the cost to the Commonwealth

tax.

of collecting income tax from any nonresident owners who do not

Corporations exempt from federal income tax under IRC

voluntarily file Virginia income tax returns and pay the tax.

§ 501.

Exempt Owners: The PTE must pay the withholding tax for all

If a nonresident owner claims to be exempt from the withholding

nonresident owners, with the following exceptions:

tax, the PTE is required to obtain documentation from the

• Individuals who are exempt from paying federal income taxes

nonresident owner setting forth the basis for such exemption.

based on their status or who are exempt from Virginia income

This documentation must be retained by the PTE with its records.

taxes. The exemption must apply to the individual’s share of

The determination of nonresident status will be based on the

the PTE’s income. Examples are diplomatic immunity and

owner’s address of record for the PTE unless the PTE has other

individuals who did not have any liability for Virginia income

information relating to the owner’s residence or commercial

tax in the previous year and who do not expect to have any

domicile by reason of the owner’s participation in management of

liability in the current year.

the PTE. If an owner is also employed by the PTE the information

• Entities other than individuals and corporations that are

relating to withholding on wages shall also be considered.

exempt from paying federal income taxes by reason of their

The PTE shall provide with its return of withholding tax a list of

every individual, corporation and other entity claiming exemption

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

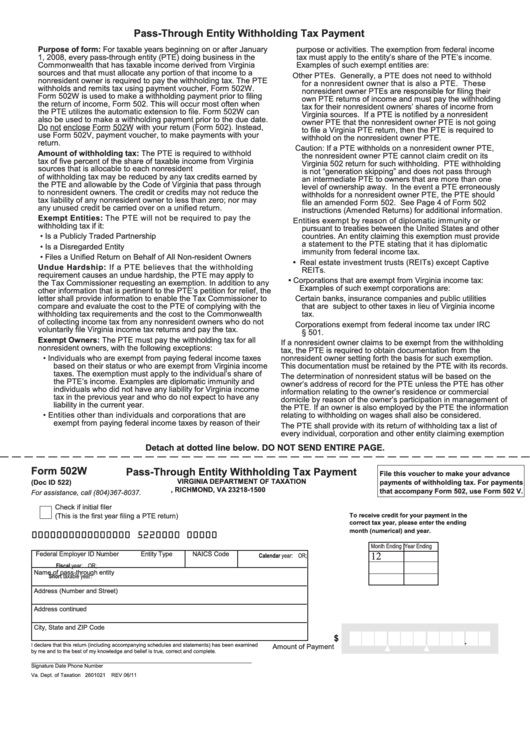

Form 502W

Pass-Through Entity Withholding Tax Payment

File this voucher to make your advance

VIRGINIA DEPARTMENT OF TAXATION

(Doc ID 522)

payments of withholding tax. For payments

P.O. BOX 1500, RICHMOND, VA 23218-1500

that accompany Form 502, use Form 502 V.

For assistance, call (804)367-8037.

Check if initial filer

(This is the first year filing a PTE return)

To receive credit for your payment in the

correct tax year, please enter the ending

month (numerical) and year.

0000000000000000 5220000 00000

Month Ending Year Ending

12

Federal Employer ID Number

Entity Type

NAICS Code

Calendar year:

OR;

Fiscal year:

OR;

Name of pass-through entity

Short taxable year:

Address (Number and Street)

Address continued

City, State and ZIP Code

$

.

I declare that this return (including accompanying schedules and statements) has been examined

Amount of Payment

by me and to the best of my knowledge and belief is true, correct and complete.

Signature

Date

Phone Number

Va. Dept. of Taxation 2601021

REV 06/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2