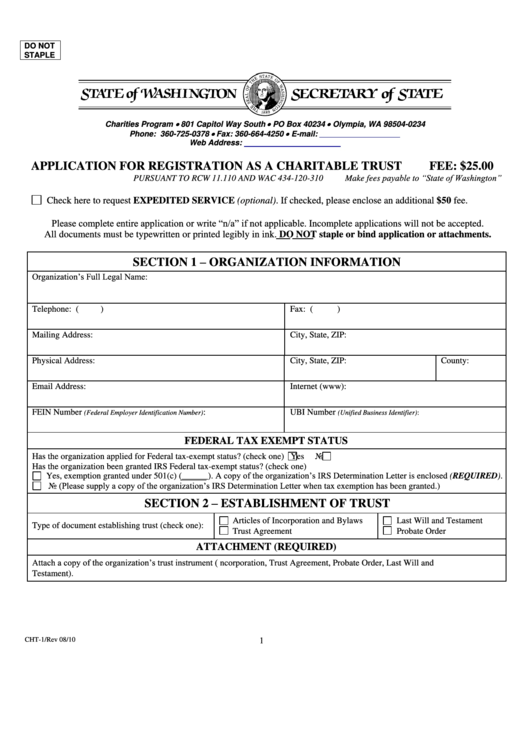

DO NOT

STAPLE

Charities Program

801 Capitol Way South

PO Box 40234

Olympia, WA 98504-0234

Phone: 360-725-0378

Fax: 360-664-4250

E-mail:

trustinfo@sos.wa.gov

Web Address:

APPLICATION FOR REGISTRATION AS A CHARITABLE TRUST

FEE: $25.00

Make fees payable to “State of Washington”

PURSUANT TO RCW 11.110 AND WAC 434-120-310

Check here to request EXPEDITED SERVICE (optional). If checked, please enclose an additional $50 fee.

Please complete entire application or write “n/a” if not applicable. Incomplete applications will not be accepted.

All documents must be typewritten or printed legibly in ink. DO NOT staple or bind application or attachments.

SECTION 1 – ORGANIZATION INFORMATION

Organization’s Full Legal Name:

Telephone: (

)

Fax: (

)

Mailing Address:

City, State, ZIP:

Physical Address:

City, State, ZIP:

County:

Email Address:

Internet (www):

FEIN Number

:

UBI Number

(Federal Employer Identification Number)

(Unified Business Identifier):

FEDERAL TAX EXEMPT STATUS

Has the organization applied for Federal tax-exempt status? (check one)

Yes

No

Has the organization been granted IRS Federal tax-exempt status? (check one)

Yes, exemption granted under 501(c) (______). A copy of the organization’s IRS Determination Letter is enclosed (REQUIRED).

No (Please supply a copy of the organization’s IRS Determination Letter when tax exemption has been granted.)

SECTION 2 – ESTABLISHMENT OF TRUST

Articles of Incorporation and Bylaws

Last Will and Testament

Type of document establishing trust (check one):

Trust Agreement

Probate Order

ATTACHMENT (REQUIRED)

Attach a copy of the organization’s trust instrument (e.g. Articles of Incorporation, Trust Agreement, Probate Order, Last Will and

Testament).

CHT-1/Rev 08/10

1

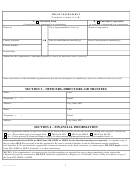

1

1 2

2 3

3 4

4