Application Form For West Virginia Economic Opportunity Tax Credit For Investments Placed In Service On Or After January 1, 2003 - West Virginia State Tax Department

ADVERTISEMENT

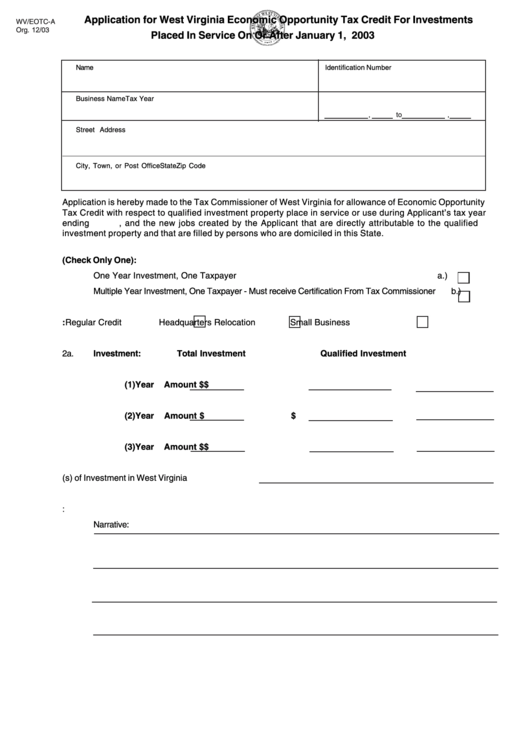

Application for West Virginia Economic Opportunity Tax Credit For Investments

WV/EOTC-A

Org. 12/03

Placed In Service On Or After January 1, 2003

Name

Identification Number

Business Name

Tax Year

,

to

,

Street Address

City, Town, or Post Office

State

Zip Code

Application is hereby made to the Tax Commissioner of West Virginia for allowance of Economic Opportunity

Tax Credit with respect to qualified investment property place in service or use during Applicant’s tax year

ending

, and the new jobs created by the Applicant that are directly attributable to the qualified

investment property and that are filled by persons who are domiciled in this State.

1a.

Application Status (Check Only One):

One Year Investment, One Taxpayer

a.)

Multiple Year Investment, One Taxpayer - Must receive Certification From Tax Commissioner

b.)

1b.

Type of Credit:

Regular Credit

Headquarters Relocation

Small Business

2a.

Investment:

Total Investment

Qualified Investment

(1)

Year

Amount $

$

(2)

Year

Amount $

$

(3)

Year

Amount $

$

2b.

Locations(s) of Investment in West Virginia

2c.

General Description of Qualified Investment:

Narrative:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2