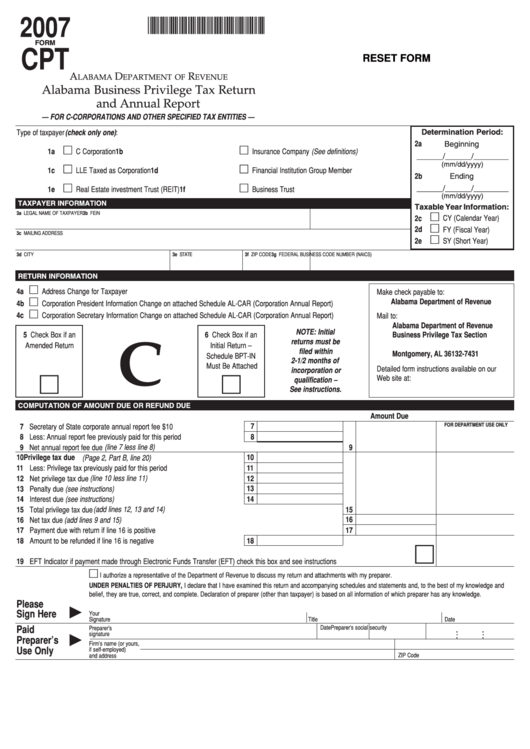

*07128301CPT*

2007

FORM

CPT

RESET FORM

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Alabama Business Privilege Tax Return

and Annual Report

— FOR C-CORPORATIONS AND OTHER SPECIFIED TAX ENTITIES —

Determination Period:

Type of taxpayer (check only one) :

2a

Beginning

1a

C Corporation

1b

Insurance Company (See definitions)

______/______/________

(mm/dd/yyyy)

1c

LLE Taxed as Corporation

1d

Financial Institution Group Member

2b

Ending

______/______/________

1e

Real Estate investment Trust (REIT)

1f

Business Trust

(mm/dd/yyyy)

TAXPAYER INFORMATION

Taxable Year Information:

3a LEGAL NAME OF TAXPAYER

3b FEIN

2c

CY (Calendar Year)

2d

FY (Fiscal Year)

3c MAILING ADDRESS

2e

SY (Short Year)

3d CITY

3e STATE

3f ZIP CODE

3g FEDERAL BUSINESS CODE NUMBER (NAICS)

RETURN INFORMATION

4a

Address Change for Taxpayer

Make check payable to:

Alabama Department of Revenue

4b

Corporation President Information Change on attached Schedule AL-CAR (Corporation Annual Report)

4c

Corporation Secretary Information Change on attached Schedule AL-CAR (Corporation Annual Report)

Mail to:

Alabama Department of Revenue

NOTE: Initial

5 Check Box if an

6 Check Box if an

Business Privilege Tax Section

returns must be

C

P.O. Box 327431

Amended Return

Initial Return –

filed within

Montgomery, AL 36132-7431

Schedule BPT-IN

2-1/2 months of

Must Be Attached

Detailed form instructions available on our

incorporation or

Web site at:

qualification –

See instructions.

COMPUTATION OF AMOUNT DUE OR REFUND DUE

Amount Due

FOR DEPARTMENT USE ONLY

7 Secretary of State corporate annual report fee $10 . . . . . . . . . . . . . . . . . . .

7

8 Less: Annual report fee previously paid for this period . . . . . . . . . . . . . . . . .

8

9 Net annual report fee due (line 7 less line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Privilege tax due (Page 2, Part B, line 20) . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Less: Privilege tax previously paid for this period . . . . . . . . . . . . . . . . . . . . .

11

12 Net privilege tax due (line 10 less line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Penalty due (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Interest due (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Total privilege tax due (add lines 12, 13 and 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 Net tax due (add lines 9 and 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Payment due with return if line 16 is positive . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18 Amount to be refunded if line 16 is negative . . . . . . . . . . . . . . . . . . . . . . . . .

18

19 EFT Indicator if payment made through Electronic Funds Transfer (EFT) check this box and see instructions. . . . . . . . . . . . . . . . . . . . . .

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

UNDER PENALTIES OF PERJURY, I declare that I have examined this return and accompanying schedules and statements and, to the best of my knowledge and

belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Please

Sign Here

Your

Signature

Title

Date

Date

Phone number

Preparer’s social security no.

Paid

Preparer’s

signature

Preparer’s

Firm’s name (or yours,

E.I. No.

Use Only

if self-employed)

ZIP Code

and address

1

1 2

2