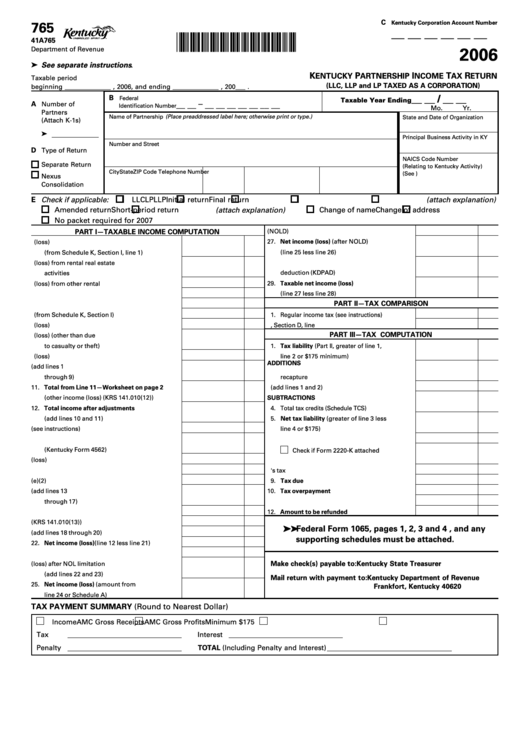

Form 765 - Kentucky Partnership Income Tax Return (Llc, Llp And Lp Taxed As A Corporation) - 2006

ADVERTISEMENT

C

Kentucky Corporation Account Number

765

__ __ __ __ __ __

*0600010263*

41A765

Department of Revenue

2006

.

➤ See separate instructions

K

P

I

T

R

ENTUCKY

ARTNERSHIP

NCOME

AX

ETURN

Taxable period

(LLC, LLP and LP TAXED AS A CORPORATION)

beginning ______________ , 2006, and ending ______________ , 200___ .

__ __ / __ __

B

Federal

Taxable Year Ending

__ __ – __ __ __ __ __ __ __

A

Number of

Identification Number

Mo.

Yr.

Partners

Name of Partnership (Place preaddressed label here; otherwise print or type.)

State and Date of Organization

(Attach K-1s)

➤

Principal Business Activity in KY

Number and Street

D

Type of Return

NAICS Code Number

Separate Return

(Relating to Kentucky Activity)

City

State

ZIP Code

Telephone Number

(See )

Nexus

Consolidation

E Check if applicable:

LLC

LP

LLP

Initial return

Final return (attach explanation)

Short-period return (attach explanation)

Amended return

Change of name

Change of address

No packet required for 2007

PART I—TAXABLE INCOME COMPUTATION

26. Net operating loss deduction (NOLD) ..............

27. Net income (loss) (after NOLD)

1. Kentucky ordinary income (loss)

(from Schedule K, Section I, line 1) ....................

(line 25 less line 26) ...........................................

28. Kentucky domestic production activities

2. Net income (loss) from rental real estate

deduction (KDPAD) ............................................

activities ...............................................................

29. Taxable net income (loss)

3. Net income (loss) from other rental activities ....

(line 27 less line 28) ...........................................

4. Interest income ....................................................

PART II—TAX COMPARISON

5. Royalty income ....................................................

6. Net capital gain (from Schedule K, Section I) ....

1. Regular income tax (see instructions) ..................

7. Other portfolio income (loss) ..............................

2. Schedule AMC, Section D, line 1 ......................

PART III—TAX COMPUTATION

8. Section 1231 net gain (loss) (other than due

to casualty or theft) ..............................................

1. Tax liability (Part II, greater of line 1,

9. Other income (loss) .............................................

line 2 or $175 minimum) .....................................

ADDITIONS

10. Total additions (add lines 1

2. Recycling/composting equipment tax credit

through 9) .............................................................

recapture ............................................................

11. Total from Line 11—Worksheet on page 2

3. Total (add lines 1 and 2) ....................................

(other income (loss) (KRS 141.010(12)) ..............

SUBTRACTIONS

12. Total income after adjustments

4. Total tax credits (Schedule TCS) ............................

(add lines 10 and 11) ............................................

5. Net tax liability (greater of line 3 less

13. Charitable contributions (see instructions) ........

line 4 or $175) .....................................................

14. Section 179 expense deduction

6. Estimated tax payments ....................................

(Kentucky Form 4562) ..........................................

Check if Form 2220-K attached

15. Deductions related to portfolio income (loss) ....

7. Extension tax payment ......................................

16. Other deductions .................................................

8. Prior year's tax credit .........................................

17. Section 59(e)(2) expenses ...................................

9. Tax due ...............................................................

18. Total deductions (add lines 13

10. Tax overpayment ...............................................

through 17) ...........................................................

11. Credited to 2007 .................................................

19. Oil and gas depletion ...........................................

12. Amount to be refunded .....................................

20. Other adjustments (KRS 141.010(13)) ................

➤ ➤ ➤ ➤ ➤ Federal Form 1065, pages 1, 2, 3 and 4 , and any

21. Total deductions (add lines 18 through 20) ........

supporting schedules must be attached.

22. Net income (loss) (line 12 less line 21) ...............

23. Current net operating loss adjustment .............

24. Income (loss) after NOL limitation

Make check(s) payable to:

Kentucky State Treasurer

(add lines 22 and 23) ..........................................

Mail return with payment to:

Kentucky Department of Revenue

25. Net income (loss) (amount from

Frankfort, Kentucky 40620

line 24 or Schedule A) .......................................

TAX PAYMENT SUMMARY (Round to Nearest Dollar)

Income

AMC Gross Receipts

AMC Gross Profits

Minimum $175

Tax

Interest

Penalty

TOTAL (Including Penalty and Interest)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4