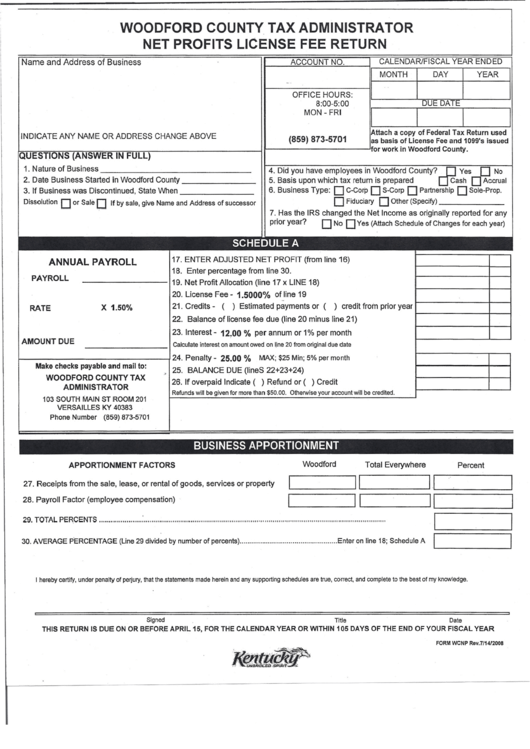

Woodford County Tax Administrator Net Profits License Fee Return Form

ADVERTISEMENT

I

t--_---'-'A.;::.C.;::.CO=U:....:.NT.!....!..,!N.,::::;O.:.....

_-1,.--::C:..:...A=L=E:....:.ND:.:....:.AR/FISCAL

YEAR ENDED

MONTH

I

DAY

I

YEAR

DUE DATE

---,1

Il...---l

I-----.JI

Attach a copy of Federal Tax Return used

as basis of License Fee and 1099's issued

'=="-:-=:=:-:-:C":":"-,-;;"7":"::==,..-;-:-~;-;-;--;-:------------{

f------------'for

work in Woodford County.

QUESTIONS (ANSWER IN FULL)

1.

Nature of Business

_

2. Date Business

Started in Woodford

County

_

3. If Business

was Discontinued,

State When

_

Dissolution

0

or Sale

0

If by sale, give Name and Address of successor

OFFICE

HOURS:

8:00-5:00

MON - FRI

WOODFORD COUNTY TAX ADMINISTRATOR

NET PROFITS LICENSE FEE RETURN

Name and Address of Business

INDICATE

ANY NAME OR ADDRESS

CHANGE

ABOVE

(859) 873-5701

4.

Did you have employees

in Woodford

County?

0

Yes

0

No

5.

Basis upon which tax return is prepared

DCash

0

Accrual

6.

Business

Type:

0

c-ccre

0

S-Corp

0

Partnership

0

Sole-Prop.

o

Fiduciary

0

Other (Specify)

_

7. Has the IRS changed

the Net Income as originally

reported

for any

prior year?

0

No

0

Yes (Attach Schedule of Changes for each year)

SCHEDULE A

ANNUAL PAYROLL

17.

ENTER ADJUSTED

NET PROFIT

(from line

16)

1

B. Enter percentage

from line

30.

PAYROLL

19.

Net

Profit Allocation

(line 17 x LINE

18)

20.

License

Fee -

1.5000%

of

line

19

-

RATE

X 1.50%

21.

Credits -

(

) Estimated

payments

or (

) credit from prior year

22.

Balance

of license fee due (line

20

minus line

21)

23.

Interest -

12~00 %

per annum or

1%

per month

AMOUNT

DUE

Calculateinterest on amountowed on Ijne

20

from original due date

24.

Penalty

-

25.00 %

MAX; $25 Min; 5% per month

Make checks payable and mail to:

25.

BALANCE

DUE (lineS

22+23+24)

•

WOODFORD

COUNTY

TAX

26.

If overpaid

Indicate ( ) Refund or ( ) Credit

ADMINISTRATOR

103 SOUTH MAIN ST ROOM 201

Refundswill be given for morethan

$50.00.

Otherwiseyour

accountwill be

credited.

VERSAILLES KY 40383

Phone Number

(859) 873-5701

BUSINESS APPORTIONMENT

APPORTIONMENT

FACTORS

Woodford

Total Everywhere

Percent

27.

Receipts

from the

sale, lease,

or rental of goods, services

or property

II

1.1========

28.

Payroll Factor (employee

compensation)

.

II

11

_

29. TOTAL PERCENTS

:............................................................................................................................

I

========~

30.

AVERAGE PERCENTAGE (Line 29 divided by number of percents)

Enter on line

18;

Schedule A

I

-------

I

herebycertify,

under penaltyof perjury,that the statementsmade herein and any supportingschedulesare true, correct,and completeto the bestof my knowledge.

Signed

Title

Date

THIS RETURN IS DUE ON OR BEFORE APRIL 15, FOR THE CALENDAR YEAR OR WITHIN 105 DAYS OF THE END OF YOUR FISCAL YEAR

FORM WCNP

Rev.7/14/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2